Chapter 14 Capital Structure and Financial Ratios

1. Objectives

1.1 Define, calculate and explain the significance to a company’s financial position and financial risk of its level of the following ratios:

(a) operating gearing

(b) financial gearing

(c) interest cover

(d) interest yield

(e) dividend cover

(f) dividend per share

(g) dividend yield

(h) earnings per share (EPS)

(i) price/earnings (P/E) ratio

1.2 Assess a company’s financial position and financial risk in a scenario by calculating and assessing appropriate ratios.

1.3 Assess the impact of sources of finance on the financial position and financial risk of a company by considering the effect on shareholder wealth.

2. Operating Gearing

2.1 |

Definition (Jun 12) |

||||||||||||||||

|

Operating gearing is a measure of the extent to which a firm’s operating costs are fixed rather than variable as this affects the level of business risk in the firm. Operating gearing can be measured in a number of different ways, including:

Contribution is sales minus variable cost of sales. |

2.2 Firms with a high proportion of fixed costs in their cost structures are known as having high operating gearing.

2.3 |

Example 1 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Two firms have the following cost structures:

What is the level of operating gearing in each and what would be the impact on each of a 10% increase in sales? Solution: Operating gearing can be calculated as follows:

Firm B carries a higher operating gearing because it has higher proportion of fixed costs. Its operating earnings will therefore be more volume-sensitive:

Firm B has enjoyed an increase in EBIT of 40% whilst Firm A has had an increase of only 20%. In the same way a decrease in sales would bring about a greater fall in B’s earning than in A’s. |

2.4 |

Example 2 |

|

If a company were to automate its production line to replace the workers currently paid an hourly wage, what would be the expected effect on its operating gearing? Solution: Swapping variable costs for fixed would increase the level of operating gearing. |

3. Financial Gearing

3.1 Financial gearing is the amount of debt finance a company uses relative to its equity finance.

3.2 Financial risk

3.2.1 |

Financial risk (Jun 12) |

|

The greater the level of debt, the more financial risk (of reduced dividends after the payment of debt interest) to the shareholder of the company, so the higher is their required return. |

3.2.2 Financial risk can be seen from different points of view.

(a) The company as a whole – If a company builds up debts that it cannot pay when they fall due, it will be forced into liquidation.

(b) Payables – If a company cannot pay its debts, the company will go into liquidation owing payables money that they are unlikely to recover in full. Lenders will thus want a higher interest yield to compensate them for higher financial risk and gearing.

(c) Ordinary shareholders – A company will not make any distributable profits unless it is able to earn enough profit before interest and tax to pay all its interest charges, and then tax. Ordinary shareholders will probably want a bigger expected return from their shares to compensate them for a higher financial risk.

3.3 Gearing ratios (Dec 12)

3.3.1 |

Financial Gearing |

||||||||||||

|

Financial gearing measures the relationship between shareholders’ capital plus reserves and capital or borrowings or both.

Note: |

3.3.2 The ratios can be calculated on either book or market values of debt and equity. There are arguments in favour of both approaches:

(a) Market values:

(i) are more relevant to the level of investment made

(ii) represent the opportunity cost of the investment made

(iii) are consistent with the way investors measure debt and equity.

(b) Book values:

(i) are not subject to sudden change due to the market factors

(ii) are readily available.

3.3.3 |

Example 3 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The following excerpt has been obtained from the financial statements of ABC Co.

Income statement excerpt

Calculate: (a) Equity gearing For ABC Co using both statement of financial position and market values.

Solution: (a) Equity gearing

Note: Since preference shares are treated as debt, equity gearing could also be described as the debt/equity ratio. (b) Capital gearing

(c) Interest gearing

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3.3.4 Impact of financial gearing – where two companies have the same level of variability in earnings, the company with the higher level of financial gearing will have increased variability of returns to shareholders.

3.3.5 |

Example 4 |

||||||||||||||||||||||||||||||||||||||||||

|

Calculate the impact on Firm C of a 10% fall in sales and comment on your results:

Solution:

The impact of a 10% decrease in sales has reduced operating earnings by (3 – 2.2)/3 = 26.67%. The increased volatility can be explained by the high operating gearing in C. However, C also has debt interest obligations. This financial gearing has the effect of amplifying the variability of returns to shareholders. The 10% drop in sales has caused the overall return to fall by (1 – 0.2)/1 = 80%. The additional 53.33% variation over and above the change in operating earnings is due to the use of debt finance. |

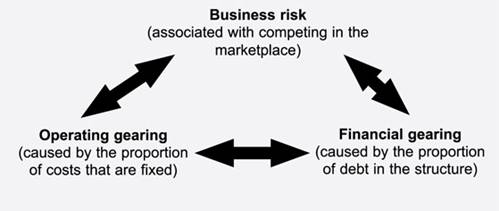

3.3.6 Overall therefore there is a required trade-off between:

4. Effect on Shareholder Wealth

(Pilot, Dec 08, Jun 09, Dec 09, Jun 11, Dec 11, Jun 13)

4.1 If a company can generate returns on capital in excess of the interest payable on debt, financial gearing will raise the EPS. Gearing will, however, also increase the variability of returns for shareholders and increase the chance of corporate failure.

4.2 Earnings per share (EPS)

4.2.1 Basic EPS should be calculated by dividing the net profit or loss for the period attributable to ordinary shareholders by the weighted average number of ordinary shares outstanding during the period.

EPS = |

Profit after tax and preference dividends |

Weighted average number of shares |

4.3 Price-earnings ratio (P/E)

4.3.1 P/E ratio is the ratio of a company’s current share price to the latest EPS. A high P/E ratio indicates strong market confidence in the future profit growth of the company. Conversely a low P/E ratio indicates low market confidence in the company making a profit.

4.3.2 The value of the P/E ratio reflects the market’s appraisal of the share’s future prospects. If EPS falls because of an increased burden arising from increased gearing, an increased P/E ratio will mean that the share price has not fallen as much as earnings, indicating the market views positively the projects that the increased gearing will fund.

P/E Ratio = |

Market price per share |

EPS |

4.4 Dividend cover

4.4.1 It is a measure of how many times the company’s earnings could pay the dividend. The higher the cover, the better the ability to maintain dividends, if profits drop.

4.4.2 This needs to be looked at in the context of how stable a company’s earnings are: a low level of dividend cover might be acceptable in a company with very stable profits, but the same level of cover in a company with volatile profits would indicate that dividends are at risk.

4.4.3 To judge the effect of increased gearing on dividend cover, you should consider changes in the dividend levels and changes in dividend cover. If earnings decrease because of an increased burden of interest payments, then:

(a) the directors may decide to make corresponding reductions in dividend to maintain levels of dividend cover.

(b) Alternatively the directors may choose to maintain dividend levels, in which case dividend cover will fall. This will indicate to shareholders an increased risk that the company will not be able to maintain the same dividend payments in future years, should earnings fall.

Dividend cover = |

EPS |

DPS |

4.5 Dividend yield

4.5.1 Dividend yield is the rate of return a shareholder is expecting on an investment in shares of a company. Since shareholders expect dividend yield and capital growth, dividend yield is an important indicator of a share’s performance.

4.5.2 The yield will be influenced by the dividend policy of an organization; a company which has traditionally paid high dividends will be popular with some investors and this will be reflected in its share price.

4.5.3 From investor’s standpoint, the dividend yield indicates the return that an investor earns from holding shares in a particular company, and the higher the dividend yield the better. A low dividend yield might persuade investors to dispose of shares and invest the proceeds elsewhere.

4.5.4 If the additional debt finance is expected to be used to generate good returns in the long-term, it is possible that the dividend yield might fall significantly in the short-term because of a fall in short-term dividends, but also an increase in the market price reflecting market expectations of enhanced long-term dividends.

Dividend yield = |

Gross DPS |

x 100% |

Market price per share |

The gross dividend is the dividend paid plus the appropriate tax credit.

5. Debt Holder Ratios

(Pilot, Jun 09, Jun 10, Dec 10, Jun 11, Jun 13)

5.1 Interest cover

5.1.1 Interest on loan stock (debenture stock) must be paid whether or not the company makes a profit.

5.1.2 Interest cover is a measure of the adequacy of a company’s profits relative to its interest payments on its debt:

Interest cover = |

PBIT |

Debt interest |

5.1.3 In general, a high level of interest cover is good but may also be interpreted as a company failing to exploit gearing opportunities to fund projects at a lower cost than from equity finance.

5.2 Interest yield

5.2.1 The interest yield is the interest or coupon rate expressed as a percentage of the market price. It is a measure of return on investment for the debt holder.

Interest yield = |

Interest rate |

Market value of debt |

Examination Style Questions

Question 1

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

The par value of the shares of JJG Co is $1·00 per share. The general level of inflation has averaged 4% per year in the period under consideration. The bonds of JJG Co are currently trading at their par value of $100. The following values for the business sector of JJG Co are available:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.

(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio.

(6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

(Total 25 marks)

(ACCA F9 Financial Management June 2009 Q4)

Question 2

Droxfol Co is a listed company that plans to spend $10m on expanding its existing business. It has been suggested that the money could be raised by issuing 9% loan notes redeemable in ten years’ time. Current financial information on Droxfol Co is as follows.

Income statement information for the last year

|

$000 |

|

Profit before interest and tax |

7,000 |

|

Interest |

(500) |

|

Profit before tax |

6,500 |

|

Tax |

(1,950) |

|

Profit for the period |

4,550 |

|

|

|

|

Statement of financial position for the last year |

$000 |

$000 |

Non-current assets |

|

20,000 |

Current assets |

|

20,000 |

Total assets |

|

40,000 |

|

|

|

Equity and liabilities |

|

|

Ordinary shares, par value $1 |

5,000 |

|

Retained earnings |

22,500 |

|

Total equity |

|

27,500 |

10% loan notes |

5,000 |

|

9% preference shares, par value $1 |

2,500 |

|

Total non-current liabilities |

|

7,500 |

Current liabilities |

|

5,000 |

Total equity and liabilities |

|

40,000 |

The current ex div ordinary share price is $4.50 per share. An ordinary dividend of 35 cents per share has just been paid and dividends are expected to increase by 4% per year for the foreseeable future. The current ex div preference share price is 76.2 cents. The loan notes are secured on the existing non-current assets of Droxfol Co and are redeemable at par in eight years’ time. They have a current ex interest market price of $105 per $100 loan note. Droxfol Co pays tax on profits at an annual rate of 30%.

The expansion of business is expected to increase profit before interest and tax by 12% in the first year. Droxfol Co has no overdraft.

Average sector ratios:

Financial gearing: 45% (prior charge capital divided by equity capital on a book value basis)

Interest coverage ratio: 12 times

Required:

(a) Calculate the current weighted average cost of capital of Droxfol Co. (9 marks)

(b) Discuss whether financial management theory suggests that Droxfol Co can reduce its weighted average cost of capital to a minimum level. (8 marks)

(c) Evaluate and comment on the effects, after one year, of the loan note issue and the expansion of business on the following ratios:

(i) interest coverage ratio;

(ii) financial gearing;

(iii) earnings per share.

Assume that the dividend growth rate of 4% is unchanged. (8 marks)

(Total 25 marks)

(ACCA F9 Financial Management Pilot Paper 2008 Q1)

Question 3

YGV Co is a listed company selling computer software. Its profit before interest and tax has fallen from $5 million to $1 million in the last year and its current financial position is as follows:

YGV Co has been advised by its bank that the current overdraft limit of $4·5 million will be reduced to $500,000 in two months’ time. The finance director of YGV Co has been unable to find another bank willing to offer alternative overdraft facilities and is planning to issue bonds on the stock market in order to finance the reduction of the overdraft. The bonds would be issued at their par value of $100 per bond and would pay interest of 9% per year, payable at the end of each year. The bonds would be redeemable at a 10% premium to their par value after 10 years. The finance director hopes to raise $4 million from the bond issue.

The ordinary shares of YGV Co have a par value of $1·00 per share and a current market value of $4·10 per share. The cost of equity of YGV Co is 12% per year and the current interest rate on the overdraft is 5% per year. Taxation is at an annual rate of 30%.

Other financial information:

![]()

Required:

(a) Calculate the after–tax cost of debt of the 9% bonds. (4 marks)

(b) Calculate and comment on the effect of the bond issue on the weighted average cost of capital of YGV Co, clearly stating any assumptions that you make.

(5 marks)

(c) Calculate the effect of using the bond issue to finance the reduction in the overdraft on:

(i) the interest coverage ratio;

(ii) gearing.

(4 marks)

(d) Evaluate the proposal to use the bond issue to finance the reduction in the overdraft and discuss alternative sources of finance that could be considered by YGV Co, given its current financial position. (12 marks)

(Total 25 marks)

(ACCA F9 Financial Management June 2010 Q2)

Source: https://hkiaatevening.yolasite.com/resources/HKSCFMNotes/Chapter14-CapitalStructureFinancialRatios.doc

Web site to visit: https://hkiaatevening.yolasite.com

Author of the text: indicated on the source document of the above text

If you are the author of the text above and you not agree to share your knowledge for teaching, research, scholarship (for fair use as indicated in the United States copyrigh low) please send us an e-mail and we will remove your text quickly. Fair use is a limitation and exception to the exclusive right granted by copyright law to the author of a creative work. In United States copyright law, fair use is a doctrine that permits limited use of copyrighted material without acquiring permission from the rights holders. Examples of fair use include commentary, search engines, criticism, news reporting, research, teaching, library archiving and scholarship. It provides for the legal, unlicensed citation or incorporation of copyrighted material in another author's work under a four-factor balancing test. (source: http://en.wikipedia.org/wiki/Fair_use)

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

The texts are the property of their respective authors and we thank them for giving us the opportunity to share for free to students, teachers and users of the Web their texts will used only for illustrative educational and scientific purposes only.

All the information in our site are given for nonprofit educational purposes