Chapter 10 Cash and Funding Strategies

1. Objectives

1.1 Explain the main reasons for a business to hold cash.

1.2 Define and explain the use of cash budgets and cash flow forecasts.

1.3 Discuss the advantages and disadvantages of centralized treasury management and cash control.

1.4 Calculate the optimum cash management strategy using the Baumol cash management model.

1.5 Calculate the optimum cash management strategy using the Miller-Orr cash management model.

1.6 Explain the ways in which a firm can invest cash short-term.

1.7 Explain the ways in which a firm can borrow cash short-term.

1.8 Explain the main strategies available for the funding of working capital.

1.9 Explain the distinction between permanent and fluctuating current assets.

Chapter Summary

2. Reasons for Holding Cash

(Dec 12)

2.1 Although cash needs to be invested to earn returns, businesses need to keep a certain amount readily available.

2.2 |

Motives of Holding Cash |

|

(a) Transaction motive – cash required to meet day-to-day expenses, e.g. payroll, payment of suppliers, etc. |

2.3 Failure to carry sufficient cash levels can lead to:

(a) loss of settlement discounts

(b) loss of supplier goodwill

(c) poor industrial relations

(d) potential liquidation.

2.4 Once again therefore the firm faces a balancing act:

3. Cash Budgets and Cash Flow Forecasts

3.1 A cash forecast is an estimate of cash receipts and payments for a future period under existing conditions.

3.2 A cash budget is a commitment to a plan for cash receipts and payments for a future period after taking any action necessary to bring the forecast into line with the overall business plan.

3.3 The usefulness of cash flow forecasts

3.3.1 The cash flow forecast is one of the most important planning tools that an organization can use. It shows the cash effect of all plans made within the flow forecastary process and hence its operation can lead to a modification of flow forecasts if it shows that there are insufficient cash resources to finance the planned operations.

3.3.2 It can also give management an indication of potential problems that could arise and allows them the opportunity to take action to avoid such problems.

3.3.3 A cash flow forecast can show four positions. Management will need to take appropriate action depending on the potential position.

Cash Position |

Appropriate Management Action |

Short-term surplus |

|

Short-term deficit |

|

Long-term surplus |

|

Long-term deficit |

|

3.4 Preparing cash flow forecast

(Jun 09, Dec 09)

3.4.1 Forecasts can be prepared from any of the following:

(a) planned receipts and payments

(b) statement of financial position predictions

(c) working capital ratios.

(a) Preparing a cash flow forecast from planned receipts and payments

3.4.2 Every type of cash inflow and receipt, along with their timings, must be forecast. Note that cash receipts and payments differ from sales and cost of sales in the income statement because:

(a) not all cash items affect the income statement

(b) some income statement items are not cash flows

(c) actual timing of cash flows may not correspond with the accounting period in which they are recorded.

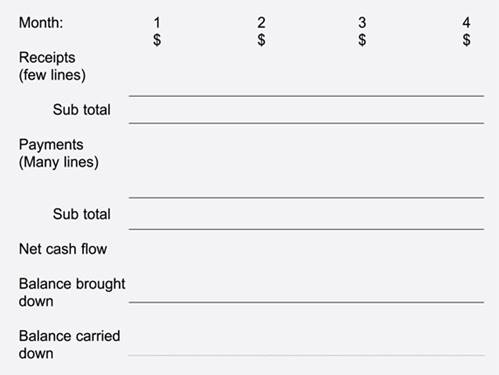

3.4.3 Proforma of cash budget

(b) Preparing a cash flow forecast from a statement of financial position

3.4.5 Used to predict the cash balance at the end of a given period, this method will typically require forecasts of:

(a) changes to non-current assets (acquisitions and disposals)

(b) future inventory levels

(c) future receivable levels

(d) future payables levels

(e) changes to share capital and other long-term funding (e.g. bank loans)

3.4.6 |

Example 2 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ABC Co has the following statement of financial position at 30 June 2010:

(a) The company expects to acquire further plant and machinery costing $8,000 during the year to 30 June 2011. Required: Produce a balance sheet forecast as at 30 June 2011, and predict what the cash balance or bank overdraft will be at that date. Solution:

The forecast is that the bank balance will increase by $65,200 (i.e. $67,200 – $2,000). This can be reconciled as follows:

|

(c) Preparing a cash flow forecast from working capital ratios

3.4.7 Working capital ratios can also be used to forecast future cash requirements. The first stage is to use the ratios to work out the working capital requirement, as we have already seen in chapter 7.

3.4.8 |

Example 3 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

X Co had the following results for last year.

X Co expects the following for the forthcoming year.

Required: Prepare a cash flow projection for the forthcoming period. Solution: Here we will assume that the gross profit percentage will remain unaltered in cash terms.

Next we calculate the working capital requirements (to the nearest $m)

Now we assemble the information in the pro forma given earlier.

Notes |

4. Treasury Management (資金管理)

4.1 |

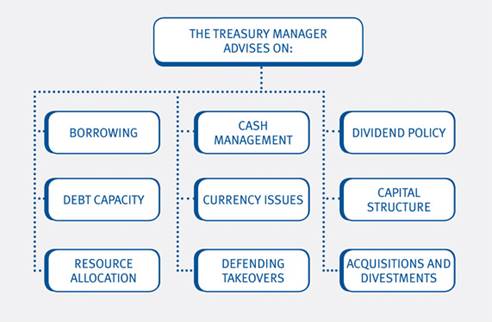

Treasury Management |

|

Treasury management is concerned with liquidity and covers the following activities: |

4.2 Originally the activities were carried out within the general finance function, but today are often separated into a treasury department, particularly in large international companies. Reasons for the change include:

(a) increase in size and global coverage of the companies

(b) increasingly international markets

(c) increase in sophistication of business practices.

4.3 Treasury responsibility

4.3.1 The treasurer will generally report to the finance director (financial manager), with a specific emphasis on borrowing and cash and currency management. The treasurer will have a direct input into the finance director’s management of debt capacity, debt and equity structure, resource allocation, equity strategy and currency strategy.

4.3.2 The treasurer will be involved in investment appraisal, and the finance director will often consult the treasurer in matters relating to the review of acquisitions and divestments, dividend policy and defence from takeover.

4.3.3 Treasury departments are not large, since they are not involved in the detailed recording of transactions.

4.4 Centralisation of the treasury department

4.4.1 The following are advantages of having a specialist centralized treasury department.

(a) Centralised liquidity management

(i) Avoid having mix of cash surpluses and overdrafts in different localized bank accounts.

(ii) Facilitates bulk cash flows, so that lower bank charges can be negotiated.

(b) Larger volumes of cash are available to invest, giving better short-term investment opportunities (for example money markets, high-interest accounts and CDs).

(c) Any borrowing can be arranged in bulk, at lower interest rates than for smaller borrowings, and perhaps on the eurocurrency or eurobond markets.

(d) Foreign exchange risk management is likely to be improved in a group of companies. A central treasury department can match foreign currency income earned by one subsidiary with expenditure in the same currency by another subsidiary. In this way, the risk of losses on adverse exchange rate movements can be avoided without the expense of forward exchange contracts or other hedging methods.

(e) A specialist treasury department can employ experts with knowledge of dealing in forward contracts, futures, options Eurocurrency markets, swaps, and so on. Localised departments could not have such expertise.

(f) The centralized pool of funds required for precautionary purposes will be smaller than the sum of separate precautionary balances which would need to be held under decentralized treasury arrangements.

(g) Through having a separate profit centre, attention will be focused on the contribution to group profit performance that can be achieved by good cash, funding, investment and foreign currency management.

4.4.2 Possible advantages of decentralized cash management are as follows.

(a) Sources of finance can be diversified and can match local assets.

(b) Greater autonomy can be given to subsidiaries and divisions because of the closer relationships they will have with the decentralized cash management function.

(c) A decentralized treasury function may be more responsive to the needs of individual operating units.

5. Cash Management Models

5.1 Cash management models are aimed at minimizing the total costs associated with movements between:

(a) a current account (very liquid but not earning interest) and

(b) short-term investments (less liquid but earning interest).

5.2 The models are devised to answer the questions:

(a) at what point should funds be moved?

(b) how much should be moved in one go?

5.3 The Baumol cash management model

5.3.1 |

Baumol Cash Management Model |

|

(a) Baumol noted that cash balances are very similar to inventory levels, and developed a model based on the economic order quantity (EOQ). |

5.3.2 |

Example 4 |

|

A company generates $10,000 per month excess cash, which it intends to invest in short-term securities. The interest rate it can expect to earn on its investment is 5% pa. The transaction costs associated with each separate investment of funds is constant at $50. Required: (a) What is the optimum amount of cash to be raised (or invested) in each transaction? Solution: (a) |

5.3.3 Drawbacks of the Baumol model

(a) In reality, it is unlikely to be possible to predict amounts required over future periods with much certainty.

(b) No buffer inventory of cash is allowed for. There may be costs associated with running out of cash.

(c) There may be other normal costs of holding cash which increase with the average amount held.

5.4 The Miller-Orr cash management model

(Pilot, Jun 12)

5.4.1 |

Miller-Orr Cash Management Model |

|

(a) The Miller-Orr model controls irregular movements of cash by the setting of upper and lower control limits on cash balance. |

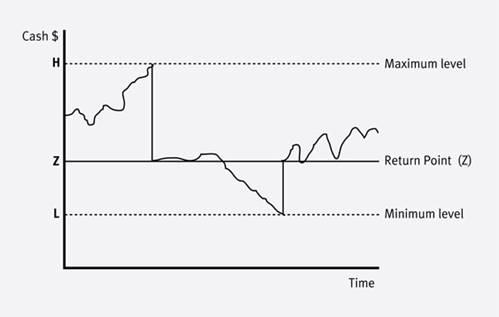

5.4.2 The diagram below shows how the model works over time.

(a) The model sets higher and lower control limits, H and L, respectively, and a target cash balance, Z.

(b) When the cash balance reaches H, then (H – Z) dollars are transferred from cash to marketable securities, i.e. the firm buys (H – Z) dollars of securities.

(c) Similarly when the cash balance hits L, then (Z – L) dollars are transferred from marketable securities to cash.

5.4.3 The lower limit, L is set by management depending upon how much risk of a cash shortfall the firm is willing to accept, and this, in turn, depends both on access to borrowings and on the consequences of a cash shortfall.

5.4.4 If the cash balance reaches the lower limit it must be replenished in some way, e.g. by the sale of marketable securities or withdrawal from a deposit account. The size of this withdrawal is the amount required to take the balance back to the return point. It is the distance between the return point (usually set in Miller-Orr as the lower limit plus one third of the distance up to the upper limit) and the lower limit.

5.4.5 If the cash balance reaches the upper limit, an amount must be invested in marketable securities or placed in a deposit account, sufficient to reduce the balance back to the return point. Again, this is calculated by the model as the distance between the upper limit and the return point.

5.4.6 The minimum cost upper limit is calculated by reference to brokerage costs, holding costs and the variance of cash flows. The model has some fairly restrictive assumptions, e.g. normally distributed cash flows but, in tests, Miller and Orr found it to be fairly robust and claim significant potential cost savings for companies.

5.4.7 |

The Formula for the Miller-Orr Model |

|

(a) Return point = Lower limit + (1/3 × spread) |

5.4.8 |

Example 5 |

|

The minimum cash balance of $20,000 is required at ABC Co, and transferring money to or from the bank costs $50 per transaction. Inspection of daily cash flows over the past year suggests that the standard deviation is $3,000 per day, and hence the variance (standard deviation squared) is $9 million. The interest rate is 0.03% per day. Calculate: (a) the spread between the upper and lower limits Solution: (a) Spread = 3 × (3/4 × 50 × 9,000,000/0.0003)1/3 = $31,200 |

6. Short-term Investment and Borrowing Solutions

6.1 The cash management models discussed above assumed that funds could be readily obtained when required either by liquidating short-term investments or by taking out short-term borrowing.

6.2 A company must choose from a range of options to select the most appropriate source of investment/funding.

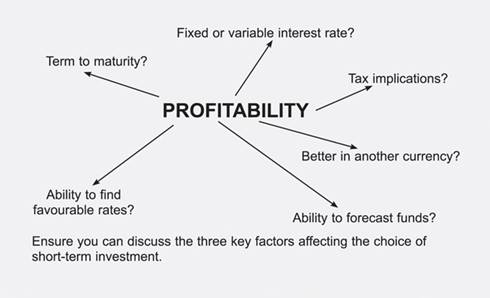

6.3 Short-term cash investments

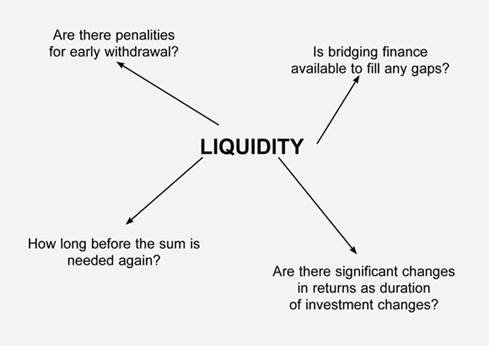

6.3.1 Short-term cash investments are used for temporary cash surpluses. To select an investment, a company has to weigh up three potentially conflicting objectives and the factors surrounding them.

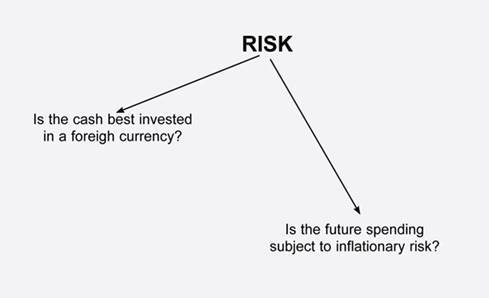

6.3.2 Objectives in the investment of surplus cash

(a) Liquidity: the cash must be available for use when needed.

(b) Safety: no risk of loss must be taken.

(c) Profitability: subject to the above, the aim is to earn the highest possible after-tax returns.

6.4 Short-term investment

6.4.1 Temporary cash surpluses are likely to be:

(a) Deposited with a bank or similar financial institution.

(b) Invested in short-term debt instruments (Debt instruments are debt securities which can be traded, e.g. certificates of deposit (CDs) and Treasury bills).

(c) Invested in longer term debt instruments, which can be sold on the stock market when the company eventually needs the cash.

(d) Invested in shares of listed companies, which can be sold on the stock market when the company eventually needs the cash.

6.4.2 A certificate of deposit (CD) is a security that is issued by a bank, acknowledging that a certain amount of money has been deposited with it for a certain period of time (usually, a short term). The CD is issued to the depositor, and attracts a stated amount of interest. The depositor will be another bank or a large commercial organization.

6.4.3 Treasury bills (短期國債) are issued weekly by the government to finance short-term cash deficiencies in the government’s expenditure program. Treasury bills have a term of 91 days to maturity, after which the holder is paid the full value of the bill.

6.5 Short-term borrowing

6.5.1 Short-term cash requirements can also be funded by borrowing from the bank. There are two main sources of bank lending:

(a) Bank overdraft

(b) Bank loans

6.5.2 Bank overdrafts are mainly provided by the clearing banks and are an important source of company finance.

Advantages |

Disadvantages |

|

|

6.5.3 Bank loans are a contractual agreement for a specific sum, loaned for a fixed period, at an agreed rate of interest. They are less flexible and more expensive than overdrafts but provide greater security.

7. Strategies for Funding Working Capital

(Pilot, Jun 09, Dec 09, Jun 12)

7.1 In the same way as for long-term investments, a firm must make a decision about what source of finance is best used for the funding of working capital requirements. The company will have access to both short-term finance (overdrafts, bank loans and trade credit as previously discussed) and longer-term sources such as debentures and equity.

7.2 Permanent or fluctuating current assets

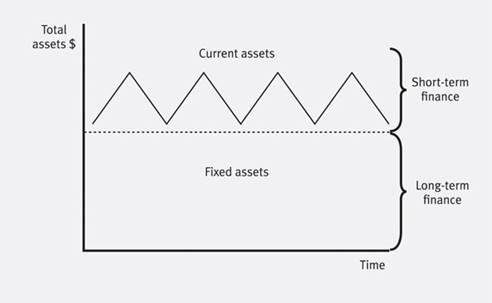

7.2.1 A company has available both short- and long-term finance. Management must make a decision about which source of funding is most appropriate to its needs.

7.2.2 Traditionally current assets were seen as short-term and fluctuating and best financed out of short-term credit which could be paid off when not required. Long-term finance was used for non-current assets, since it involves committing for a number of years and is not easily reversed.

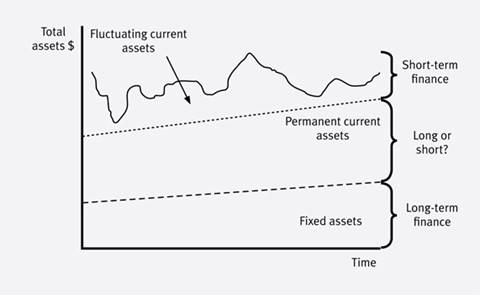

7.2.3 However this approach ignores the fact that in most businesses a proportion of the current assets are fixed over time, i.e. ‘permanent’. For example:

(a) buffer inventory

(b) receivables during the credit period

(c) minimum cash balances.

7.2.4 If growth is included in the analysis, a more realistic picture emerges:

7.2.5 The choice of how to finance the permanent current assets is a matter for managerial judgement, but includes an analysis of the cost and risks of short-term finance.

7.3 Aggressive, conservative and matching funding policies

7.3.1 There is no ideal funding package, but three approaches may be identified.

(a) Aggressive approach

(b) Conservative approach

(c) Matching approach

7.3.2 A aggressive working capital management policy is to finance most current assets, including “permanent” ones, with short-term finance. It is risky but profitable. A company can achieve these by cutting inventories, speeding up collections from customers, and delaying payments to suppliers.

The potential disadvantage of this policy is an increase in the chances of system breakdown through running out of inventory of loss of goodwill with customers and suppliers.

7.3.3 A conservative working capital management policy uses long-term finance for most current assets. It is stable but expensive and it can reduce the risk of system breakdown.

7.3.4 A matching approach is to match the duration of the investment with the duration of the finance.

7.3.5 |

Example 6 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The following three companies have current asset financing structures that may be considered as aggressive, average and defensive (conservative): Statement of financial position

The aggressive company is so termed as it is prepared to take the risk of financing more of its business investment with short-term credit. The defensive company, at the other ‘extreme’, takes on board a high proportion of longer-term debt with, consequently, less short-term credit risk. It can be seen that the aggressive company returns a higher profit but at the cost of greater risk. It is interesting to note that this higher risk is revealed in its relatively poor current ratio. |

Examination Style Questions

Question 1 – Long and Short Term Financing and Cash Operating Cycle

Blin is a company listed on a European stock exchange, with a market capitalisation of €6m, which manufactures household cleaning chemicals. The company has expanded sales quite significantly over the last year and has been following an aggressive approach to working capital financing. As a result, Blin has come to rely heavily on overdraft finance for its short-term needs. On the advice of its finance director, the company intends to take out a long-term bank loan, part of which would be used to repay its overdraft.

Required:

(a) Discuss the factors that will influence the rate of interest charged on the new bank loan, making reference in your answer to the yield curve. (9 marks)

(b) Explain and discuss the approaches that Blin could adopt regarding the relative proportions of long- and short-term finance to meet its working capital needs, and comment on the proposed repayment of the overdraft. (9 marks)

(c) Explain the meaning of the term ‘cash operating cycle’ and discuss its significance in determining the level of investment in working capital. Your answer should refer to the working capital needs of different business sectors.

(7 marks)

(Total 25 marks)

(ACCA 2.4 Financial Management and Control June 2004 Q2)

Question 2 – Cash Budgets and Baumol Model

Thorne Co values, advertises and sells residential property on behalf of its customers. The company has been in business for only a short time and is preparing a cash budget for the first four months of 2006. Expected sales of residential properties are as follows.

|

2005 |

2006 |

2006 |

2006 |

2006 |

Month |

December |

January |

February |

March |

April |

Units sold |

10 |

10 |

15 |

25 |

30 |

The average price of each property is £180,000 and Thorne Co charges a fee of 3% of the value of each property sold. Thorne Co receives 1% in the month of sale and the remaining 2% in the month after sale. The company has nine employees who are paid on a monthly basis. The average salary per employee is £35,000 per year. If more than 20 properties are sold in a given month, each employee is paid in that month a bonus of £140 for each additional property sold.

Variable expenses are incurred at the rate of 0·5% of the value of each property sold and these expenses are paid in the month of sale. Fixed overheads of £4,300 per month are paid in the month in which they arise. Thorne Co pays interest every three months on a loan of £200,000 at a rate of 6% per year. The last interest payment in each year is paid in December.

An outstanding tax liability of £95,800 is due to be paid in April. In the same month Thorne Co intends to dispose of surplus vehicles, with a net book value of £15,000, for £20,000. The cash balance at the start of January 2006 is expected to be a deficit of £40,000.

Required:

(a) Prepare a monthly cash budget for the period from January to April 2006. Your budget must clearly indicate each item of income and expenditure, and the opening and closing monthly cash balances. (10 marks)

(b) Discuss the factors to be considered by Thorne Co when planning ways to invest any cash surplus forecast by its cash budgets. (5 marks)

(c) Discuss the advantages and disadvantages to Thorne Co of using overdraft finance to fund any cash shortages forecast by its cash budgets. (5 marks)

(d) Explain how the Baumol model can be employed to reduce the costs of cash management and discuss whether the Baumol cash management model may be of assistance to Thorne Co for this purpose. (5 marks)

(25 marks)

(ACCA 2.4 Financial Management and Control December 2005 Q5)

Question 3 – Changes of credit policy, Miller-Orr Model, AR management and working capital funding policy

Ulnad Co has annual sales revenue of $6 million and all sales are on 30 days’ credit, although customers on average take ten days more than this to pay. Contribution represents 60% of sales and the company currently has no bad debts. Accounts receivable are financed by an overdraft at an annual interest rate of 7%.

Ulnad Co plans to offer an early settlement discount of 1.5% for payment within 15 days and to extend the maximum credit offered to 60 days. The company expects that these changes will increase annual credit sales by 5%, while also leading to additional incremental costs equal to 0.5% of turnover. The discount is expected to be taken by 30% of customers, with the remaining customers taking an average of 60 days to pay.

Required:

(a) Evaluate whether the proposed changes in credit policy will increase the profitability of Ulnad Co. (6 marks)

(b) Renpec Co, a subsidiary of Ulnad Co, has set a minimum cash account balance of $7,500. The average cost to the company of making deposits or selling investments is $18 per transaction and the standard deviation of its cash flows was $1,000 per day during the last year. The average interest rate on investments is 5.11%. Determine the spread, the upper limit and the return point for the cash account of Renpec Co using the Miller-Orr model and explain the relevance of these values for the cash management of the company. (6 marks)

(c) Identify and explain the key areas of accounts receivable management.

(6 marks)

(d) Discuss the key factors to be considered when formulating a working capital funding policy. (7 marks)

(Total 25 marks)

(ACCA F9 Financial Management Pilot Paper Q3)

Question 4 – Overdraft and Cash Flows Forecast

CPA is a manufacturing company in the furniture trade. Its sales have risen sharply over the past six months as a result of an improvement in the economy and a strong housing market. The company is now showing signs of ‘overtrading’ and the financial manager, Ms Smith, is concerned about its liquidity. The company is one month from its year end. Estimated figures for the full 12 months of the current year and forecasts for next year, on present cash management policies, are shown below.

|

Next year |

Current year |

Income statement |

$000 |

$000 |

Revenues |

5,200 |

4,200 |

Less: Cost of sales (Note 1) |

3,224 |

2,520 |

Operating expenses |

650 |

500 |

Operating profit |

1,326 |

1,180 |

Interest paid |

54 |

48 |

Profit before tax |

1,272 |

1,132 |

Tax payable |

305 |

283 |

Profit after tax |

967 |

849 |

|

|

|

Dividends declared |

387 |

339 |

|

|

|

Current assets and liabilities as at the end of the year |

|

|

Inventory/work-in-progress |

625 |

350 |

Receivables |

750 |

520 |

Cash |

0 |

25 |

Trade payables |

464 |

320 |

Other payables (tax and dividends) |

692 |

622 |

Overdraft |

11 |

0 |

Net current assets/(liabilities) |

208 |

(47) |

|

|

|

Note 1: Cost of sales includes depreciation of |

225 |

175 |

Ms Smith is considering methods of improving the cash position. A number of actions are being discussed.

Debtors

Offer a 2% discount to customers who pay within 10 days of despatch of invoices. It is estimated 50% of customers will take advantage of the new discount scheme. The other 50% will continue to take the current average credit period.

Trade payables and inventory

Reduce the number of suppliers currently being used and negotiate better terms with those that remain by introducing a just-in-time policy. The aim will be to reduce the end-of-year forecast cost of sales (excluding depreciation) by 5% and inventory/WIP by 10%. However, the number of days credit taken by the company will have to fall to 30 days to help persuade suppliers to improve their prices.

Other information

Required:

(a) Explain the main uses of overdraft facilities as part of a company’s working capital management policy. (5 marks)

(b) Prepare a cash flow forecast for next year, assuming:

(i) The company does not change its policies

(ii) The company’s proposals for managing customers, suppliers and inventory are implemented

In both cases, assume a full twelve-month period, that is the changes will be effective from day 1 of next year. (14 marks)

(c) As assistance to Ms Smith, write a short report to her discussing the proposed actions. Include comments on the factors, financial and non-financial, that the company should take into account before implementing the new policies.

(6 marks)

(Total 25 marks)

Question 5 – Working Capital Financing Strategies, Cash Budgets and Risks of Granting Credit to Foreign Customers

The following financial information relates to HGR Co:

Statement of financial position at the current date (extracts)

|

$000 |

$000 |

$000 |

Non-current assets |

|

|

48,965 |

Current assets |

|

|

|

Inventory |

|

8,160 |

|

Accounts receivable |

|

8,775 |

|

|

|

16,935 |

|

Current liabilities |

|

|

|

Overdraft |

3,800 |

|

|

Accounts payable |

10,200 |

|

|

|

|

14,000 |

|

Net current assets |

|

|

2,935 |

Total assets less current liabilities |

|

|

51,900 |

Cash flow forecasts from the current date are as follows:

|

Month 1 |

Month 2 |

Month 3 |

Cash operating receipts ($000) |

4,220 |

4,350 |

3,808 |

Cash operating payments ($000) |

3,950 |

4,100 |

3,750 |

Six-monthly interest on traded bonds ($000) |

|

200 |

|

Capital investment ($000) |

|

|

2,000 |

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year.

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months’ time if no action is taken; and

(ii) the bank balance in three months’ time if the finance director’s proposals are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable course of action. (10 marks)

(c) Discuss how risks arising from granting credit to foreign customers can be managed and reduced. (8 marks)

(Total 25 marks)

(ACCA F9 Financial Management June 2009 Q3)

Question 6 – Role of Financial Intermediaries, Financial Statement Forecasts, Working Capital Financing Policy and Financial Performance Forecasts

APX Co achieved a turnover of $16 million in the year that has just ended and expects turnover growth of 8·4% in the next year. Cost of sales in the year that has just ended was $10·88 million and other expenses were $1·44 million.

The financial statements of APX Co for the year that has just ended contain the following statement of financial position:

|

$m |

$m |

Non-current assets |

|

22.0 |

Current assets |

|

|

Inventory |

2.4 |

|

Trade receivables |

2.2 |

|

|

|

4.6 |

Total assets |

|

26.6 |

|

|

|

Equity finance: |

|

|

Ordinary shares |

5.0 |

|

Reserves |

7.5 |

|

|

|

12.5 |

Long-term bank loan |

|

10.0 |

|

|

22.5 |

Current liabilities |

|

|

Trade payables |

1.9 |

|

Overdraft |

2.2 |

|

|

|

4.1 |

Total equity and liabilities |

|

26.6 |

The long-term bank loan has a fixed annual interest rate of 8% per year. APX Co pays taxation at an annual rate of 30% per year.

The following accounting ratios have been forecast for the next year:

Gross profit margin: |

30% |

Operating profit margin: |

20% |

Dividend payout ratio: |

50% |

Inventory turnover period: |

110 days |

Trade receivables period: |

65 days |

Trade payables period: |

75 days |

Overdraft interest in the next year is forecast to be $140,000. No change is expected in the level of non-current assets and depreciation should be ignored.

Required:

(a) Discuss the role of financial intermediaries in providing short-term finance for use by business organisations. (4 marks)

(b) Prepare the following forecast financial statements for APX Co using the information provided:

(i) an income statement for the next year; and

(ii) a statement of financial position at the end of the next year. (9 marks)

(c) Analyse and discuss the working capital financing policy of APX Co. (6 marks)

(d) Analyse and discuss the forecast financial performance of APX Co in terms of working capital management. (6 marks)

(Total 25 marks)

(ACCA F9 Financial Management December 2009 Q4)

Question 7 – Expected value and Working Capital Management

ZSE Co is concerned about exceeding its overdraft limit of $2 million in the next two periods. It has been experiencing considerable volatility in cash flows in recent periods because of trading difficulties experienced by its customers, who have often settled their accounts after the agreed credit period of 60 days. ZSE has also experienced an increase in bad debts due to a small number of customers going into liquidation.

The company has prepared the following forecasts of net cash flows for the next two periods, together with their associated probabilities, in an attempt to anticipate liquidity and financing problems. These probabilities have been produced by a computer model which simulates a number of possible future economic scenarios. The computer model has been built with the aid of a firm of financial consultants.

Period 1 cash flow |

Probability |

Period 2 cash flow |

Probability |

$000 |

|

$000 |

|

8,000 |

10% |

7,000 |

30% |

4,000 |

60% |

3,000 |

50% |

(2,000) |

30% |

(9,000) |

20% |

ZSE Co expects to be overdrawn at the start of period 1 by $500,000.

Required:

(a) Calculate the following values:

(i) the expected value of the period 1 closing balance;

(ii) the expected value of the period 2 closing balance;

(iii) the probability of a negative cash balance at the end of period 2;

(iv) the probability of exceeding the overdraft limit at the end of period 2.

Discuss whether the above analysis can assist the company in managing its cash flows. (13 marks)

(b) Identify and discuss the factors to be considered in formulating a trade receivables management policy for ZSE Co. (8 marks)

(c) Discuss whether profitability or liquidity is the primary objective of working capital management. (4 marks)

(Total 25 marks)

(ACCA F9 Financial Management June 2010 Q1)

3.4.4 |

Example 1 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

You are presented with the following forecasted cash flow data for your organization for the period November 2010 to June 2011. It has been extracted from functional flow forecasts that have already been prepared.

You are also told the following. The managing director is pleased with the above figures as they show sales will have increased by more than 100% in the period under review. In order to achieve this he has arranged a bank overdraft with a ceiling of $50,000 to accommodate the increased inventory sales and wage bill for overtime worked. Required: (a) Prepare a cash flow forecast for the six-month January to June 2011. Solution: (a)

(b) |

Source: https://hkiaatevening.yolasite.com/resources/FMNotes/Chapter10-CashandFunding.doc

Web site to visit: https://hkiaatevening.yolasite.com

Author of the text: indicated on the source document of the above text

If you are the author of the text above and you not agree to share your knowledge for teaching, research, scholarship (for fair use as indicated in the United States copyrigh low) please send us an e-mail and we will remove your text quickly. Fair use is a limitation and exception to the exclusive right granted by copyright law to the author of a creative work. In United States copyright law, fair use is a doctrine that permits limited use of copyrighted material without acquiring permission from the rights holders. Examples of fair use include commentary, search engines, criticism, news reporting, research, teaching, library archiving and scholarship. It provides for the legal, unlicensed citation or incorporation of copyrighted material in another author's work under a four-factor balancing test. (source: http://en.wikipedia.org/wiki/Fair_use)

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

The texts are the property of their respective authors and we thank them for giving us the opportunity to share for free to students, teachers and users of the Web their texts will used only for illustrative educational and scientific purposes only.

All the information in our site are given for nonprofit educational purposes