Objectives of Working Capital Management

1.1 Objectives:

1.2 Conflict between two objectives:

1.3 Trade-off between two objectives:

1.4 Steps to achieve the objectives of working capital management:

Question 1 |

2. Cash Conversion Cycle (Cash Operating Cycle, Working Capital Cycle or Trading Cycle)

2.1 |

The Cash Operating Cycle |

|

The cash operating cycle (working capital cycle or trading cycle) is the length of time between the company’s outlay on raw materials, wages and other expenditures and the inflow of cash from the sale of goods. |

2.2 Significance (or factors) in determining the level of investment in working capital:

2.3 How to reduce the level of investment in working capital?

2.4 Calculation of the cash conversion cycle:

Raw materials holding period |

x |

Less: Payables’ payment period |

(x) |

WIP holding period |

x |

Finished goods holding period |

x |

Receivables’ collection period |

x |

|

x |

Inventory holding period |

x |

Less: Payables’ payment period |

(x) |

Receivables’ collection period |

x |

|

x |

Question 2 – Cash Operating Cycle, Working Capital Management and Factoring

All sales were on credit. Anjo plc has no long-term debt. Credit purchases in each year were 95% of cost of sales. Anjo plc pays interest on its overdraft at an annual rate of 8%. Current sector averages are as follows: Required: (a) Calculate the following ratios for each year and comment on your findings. Required: Evaluate whether the factor’s offer is financially acceptable, basing your answer on the financial information relating to 2006. (8 marks) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3. Working Capital Ratios and Overtrading

3.1 Working capital ratios may help to indicate whether a company is over-capitalized (overtrading).

3.2 Types of working capital ratios

(1) Current ratio = ![]()

(2) Quick ratio = ![]()

(3) Accounts receivable payment period = ![]()

(4) Finished goods turnover period = ![]()

(5) Raw materials holding period = ![]()

(6) WIP holding period = ![]()

(7) Accounts payable payment period = ![]()

(8) Working capital turnover = ![]()

3.3 Overtrading occurs when a business has insufficient finance for working capital to sustain its level of trading.

3.4 Symptoms of overtrading:

Question 3 – Interest Rate Risk, Overtrading and Factoring

The average variable overdraft interest rate in each year was 5%. The 8% bonds are redeemable in ten years’ time. A factor has offered to take over the administration of trade receivables on a non-recourse basis for an annual fee of 3% of credit sales. The factor will maintain a trade receivables collection period of 30 days and Gorwa Co will save $100,000 per year in administration costs and $350,000 per year in bad debts. A condition of the factoring agreement is that the factor would advance 80% of the face value of receivables at an annual interest rate of 7%. Required: (a) Discuss, with supporting calculations, the possible effects on Gorwa Co of an increase in interest rates and advise the company of steps it can take to protect itself against interest rate risk. (7 marks) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

4. Working Capital Requirement

4.1 Computing the working capital requirement is a matter of calculating the value of current assets less current liabilities, perhaps by taking averages over a one-year period.

Question 4

Average statistics relating to working capital are as follows:

(5) Credit it taken:

WIP and finished goods are valued at the cost of material, labour and variable expenses. Required: Compute the working capital requirement of ABC Co assuming that the labour force is paid for 50 working weeks in each year. |

5. Inventory Management

5.1 Costs and objective of inventory management

5.1.1 Costs of high inventory level:

5.1.2 Costs of low inventory level:

5.1.3 Objective of good inventory management is to determine:

5.2 EOQ

5.2.1 Economic order quantity (EOQ) – minimize the total cost of holding and ordering inventory.

EOQ =

C0 = Cost of placing one order

CH = Holding cost per unit of inventory for one period

D = Annual demand

5.2.2 Quantity discounts – discounts may be offered for ordering in large quantities. If the EOQ is smaller than the order size needed for discount, should the order size be increased above the EOQ?

5.2.3 Limitations of EOQ:

Question 5 – Objectives of working capital management, EOQ, AR management and foreign currency risk management Inventory management Accounts receivable management Accounts payable management

Money market rates available to PKA Co:

Assume that it is now 1 December and that PKA Co has no surplus cash at the present time. Required: |

Quantity (bulk purchase) discount

5.3.1 Discounts may be offered for ordering in large quantities. If the EOQ is smaller than the order size needed for a discount, should the order size be increased above the EOQ?

5.3.2 |

Example 1 |

||||||||||||||||||||||||||||||

|

The annual demand for an item of inventory is 125 units. The item costs $200 a unit to purchase, the holding cost for one unit for one year is 15% of the unit cost and ordering costs are $300 an order. The supplier offers a 3% discount for order of 60 units or more, and a discount of 5% for orders of 90 units or more. What is the cost minimizing order size? Solution:

(b) With a discount of 3% and an order quantity of 60 units costs are as follows.

(c) With a discount of 5% and an order quantity of 90 units costs are as follows.

The cheapest option is to order 90 units at a time. |

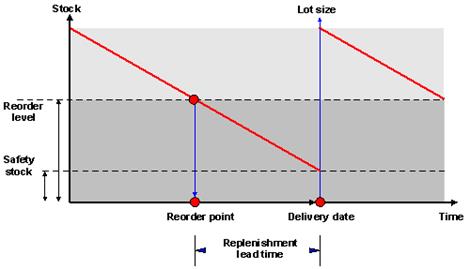

5.4 Re-order level

5.4.1 Re-order level builds in a measure of safety inventory and minimizes the risk of the organization running out of inventory.

5.4.2 |

Formula |

|

Re-order level = maximum usage × maximum level Maximum inventory level = Minimum inventory level or buffer safety inventory = Average inventory = minimum level + (re-order level ÷ 2) |

5.5 Just-in-time (JIT)

5.5.1 Meaning:

5.5.2 Advantages of JIT:

5.5.3 Disadvantages of JIT:

5.5.4 Not all businesses are appropriate to apply JIT, such as restaurant and hospital.

6. Accounts receivable management

6.1 Key areas of accounts receivable management

6.1.1 Four areas:

6.2 Factors to be considered when formulating working capital policy on the management of trade receivables

6.2.1 Factors can be summarized as follows:

6.3 Early settlement discounts

6.3.1 Advantages and disadvantages of early settlement discounts:

Advantages |

Disadvantages |

(a) Early payment reduces the receivables balance and hence the finance costs. |

(a) Difficulty in setting the appropriate terms. |

6.3.2 |

Example 3 |

|

A company is offering a cash discount of 2.5% to receivables if they agree to pay debts within one month. The usual credit period taken is three months. What is the effective annualized cost of offering the discount and should it be offered, if the bank would loan the company at 18% pa? Solution: Discount as a percentage of amount paid = 2.5 / 97.5 = 2.56% |

6.4 Factoring

6.4.1 How to assist in the management of receivables?

6.4.2 Factoring is most suitable for:

6.4.3 Advantages and disadvantages of factoring:

Advantages |

Disadvantages |

(a) Saving in administration costs – not incur the costs of running its own sales ledger department. |

(a) Likely to be more costly than an efficiently run internal credit control department. |

6.4.4 Determine whether factoring is financially acceptable:

Question 6 – Cash operating cycle and factoring

A factor has offered to manage the trade receivables of Bold Co in a servicing and factor-financing agreement. The factor expects to reduce the average trade receivables period of Bold Co from its current level to 35 days; to reduce bad debts from 0·9% of turnover to 0·6% of turnover; and to save Bold Co $40,000 per year in administration costs. The factor would also make an advance to Bold Co of 80% of the revised book value of trade receivables. The interest rate on the advance would be 2% higher than the 7% that Bold Co currently pays on its overdraft. The factor would charge a fee of 0·75% of turnover on a with-recourse basis, or a fee of 1·25% of turnover on a non-recourse basis. Assume that there are 365 working days in each year and that all sales and supplies are on credit. Required: (a) Explain the meaning of the term ‘cash operating cycle’ and discuss the relationship between the cash operating cycle and the level of investment in working capital. Your answer should include a discussion of relevant working capital policy and the nature of business operations. (7 marks) |

6.5 Invoice discounting

6.5.1 How to assist in the management of receivables?

Question 7 – EOQ, JIT, changes in AR management policy and formulating working capital management policy Inventory management WQZ Co forecasts that demand for Product KN5 will be 160,000 units in the coming year and it has traditionally ordered 10% of annual demand per order. The ordering cost is expected to be $400 per order while the holding cost is expected to be $5·12 per unit per year. A buffer inventory of 5,000 units of Product KN5 will be maintained, whether orders are made by the traditional method or using the economic ordering quantity model. Receivables management It is expected that administration and operating cost savings of $753,000 per year will be made after improving operational procedures and introducing the early settlement discount. Credit sales of WQZ Co are currently $87·6 million per year and trade receivables are currently $18 million. Credit sales are not expected to change as a result of the changes in receivables management. The company has a cost of short-term finance of 5·5% per year. Required: (a) Calculate the cost of the current ordering policy and the change in the costs of inventory management that will arise if the economic order quantity is used to determine the optimum order size for Product KN5. (6 marks) |

7. Accounts Payables Management

7.1 Normally seen as a free source of finance, but delay too long, it will have the following problems:

7.2 Calculation of early settlement discount – same as receivables early settlement discount in 5.3.2 above.

Question 8 – Formulation of working capital policy, early settlement discount and bulk purchase discount The supplier has offered either a discount of 0.5% for payment in full within 30 days, or a discount of 3.6% on orders of 30,000 or more components. If the bulk purchase discount is taken, the cost of holding components in inventory would increase to $2.20 per component per year due to the need for a larger storage facility. Assume that there are 365 days in the year and that ZPS Co can borrow short-term at 4.5% per year. Required: |

8. Foreign Trades Management

8.1 Additional two types of risks need to managed:

8.2 Solutions for credit risk:

Question 9 – Granting credit to foreign customers |

9. Cash Management

9.1 Reasons for holding cash

9.1.1 Motives for holding cash:

9.2 Cash budgets and cash flow forecasts

9.2.1 Usefulness of cash flow forecasts:

9.2.2 Forecasts can be prepared from any of the following:

Question 10 – Working Capital Financing Strategies, Cash Budgets and Risks of Granting Credit to Foreign Customers

Cash flow forecasts from the current date are as follows:

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable. HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year. Required: (a) Discuss the working capital financing strategy of HGR Co. (7 marks) |

10. Cash Management Model

10.1 Baumol Model

10.1.1 Similar to inventory levels and based on the EOQ.

10.1.2 Assumptions:

10.1.3 Formulate:

C0 = transaction costs (brokerage, commission, etc.)

D = demand for cash over the period

CH = cost of holding cash

10.1.4 Drawbacks of Baumol model:

10.1.5 |

Example 3 |

|

A company has a fixed cost of $40,000 to obtain new funds. There is a requirement for $240,000 cash over each period of one year for the foreseeable future. The interest cost of new funds is 12% per annum and the interest rate earned on short-term securities is 9% per annum. How much finance should the company raise each time that it raises new finance? Solution: The cost of holding cash is 12% – 9% = 3% The optimum level of reorder quantity = |

10.1.6 |

Example 4 |

||||||||||||||||||||||||||||||||

|

A company requires $480,000 of cash over each period of one year for the foreseeable future and is considering two alternatives: Option 1: Taking up a bank loan of $480,000 at once for one year period at an interest rate of 12% per annum on the initial balance. Any fund/cash not in use will be placed in a call deposit at 9% per annum. Which of the two options is financially better to undertake? Solution:

Total costs per annum under each option:

Option 2 should be chosen, as its total cost is marginally lower than option 1. |

Question 12 – Cash budget, overdrafts and Baumol cash model

The average price of each property is £180,000 and Thorne Co charges a fee of 3% of the value of each property sold. Thorne Co receives 1% in the month of sale and the remaining 2% in the month after sale. The company has nine employees who are paid on a monthly basis. The average salary per employee is £35,000 per year. If more than 20 properties are sold in a given month, each employee is paid in that month a bonus of £140 for each additional property sold. Variable expenses are incurred at the rate of 0·5% of the value of each property sold and these expenses are paid in the month of sale. Fixed overheads of £4,300 per month are paid in the month in which they arise. Thorne Co pays interest every three months on a loan of £200,000 at a rate of 6% per year. The last interest payment in each year is paid in December. An outstanding tax liability of £95,800 is due to be paid in April. In the same month Thorne Co intends to dispose of surplus vehicles, with a net book value of £15,000, for £20,000. The cash balance at the start of January 2006 is expected to be a deficit of £40,000. Required: (a) Prepare a monthly cash budget for the period from January to April 2006. Your budget must clearly indicate each item of income and expenditure, and the opening and closing monthly cash balances. (10 marks) |

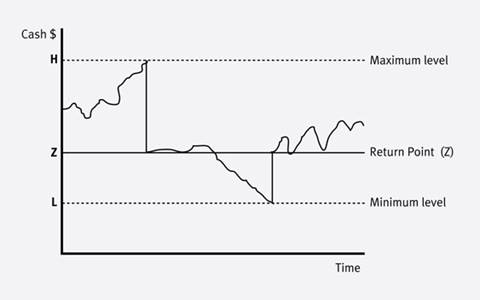

10.2 Miller-Orr Cash Management Model

10.2.1 It takes account of uncertainty in relation to receipts and payment by setting upper and lower control limits on cash balance.

10.2.2 How it works?

10.2.3 Formula:

(a) Return point = Lower limit + (1/3 × spread)

(b) Spread =

Variance and interest rates should be expressed in daily terms.

Question 13 – Changes of credit policy, Miller-Orr Model, AR management and working capital funding policy Ulnad Co plans to offer an early settlement discount of 1.5% for payment within 15 days and to extend the maximum credit offered to 60 days. The company expects that these changes will increase annual credit sales by 5%, while also leading to additional incremental costs equal to 0.5% of turnover. The discount is expected to be taken by 30% of customers, with the remaining customers taking an average of 60 days to pay. Required: (a) Evaluate whether the proposed changes in credit policy will increase the profitability of Ulnad Co. (6 marks) |

11. Short-term Investment on Cash Surplus

11.1 Factors to be considered when planning ways to invest any cash surplus:

11.2 Types of short-term investment:

12. Short-term Borrowing

12.1 Two main sources of bank lending:

12.2 Advantages and disadvantages of bank overdraft:

Advantages |

Disadvantages |

|

|

Question 14 |

13. Strategies for Funding Working Capital

13.1 Also named as follows:

13.2 Working capital financing policies can be classified into conservative, moderate (or matching) and aggressive, depending on the extent to which fluctuating current assets and permanent current assets are financed by short-term sources of finance.

13.3 Permanent current assets represent the core level of working capital investment needed to support a given level of sales, for example:

13.4 Fluctuating current assets represent the changes in working capital that arise in the normal course of business operations, for example:

13.5 Matching principle suggests that long-term finance should be used for long-term assets. Under a matching working capital funding policy, therefore, long-term finance is used for both permanent current assets and non-current assets. Short-term finance is used to cover the short-term changes in current assets represented by fluctuating current assets.

13.6 A conservative working capital funding policy will use a higher proportion of long-term finance than a matching policy, thereby financing some of the fluctuating current assets from a long-term source. This will be less risky and less profitable than a matching policy, and will give rise to occasional short-term cash surpluses.

13.7 An aggressive working capital funding policy will use a lower proportion of long-term finance than a matching policy, financing some of the permanent current assets from a short-term source such as an overdraft. This will be more risky and more profitable than a matching policy.

13.8 Other factors that influence a working capital funding policy:

13.9 A small company, for example, may be forced to adopt an aggressive working capital funding policy because it is unable to raise additional long-term finance, whether equity or debt.

Question 15 – Yield curve, financing and cash operating cycle Required: (a) Discuss the factors that will influence the rate of interest charged on the new bank loan, making reference in your answer to the yield curve. (9 marks) |

Additional Examination Style Questions

Question 16 – Cash budget, JIT, financing and working capital management

Jack Geep will set up a new business as a sole trader on 1 January 2003 making decorative glassware. Jack is in the process of planning the initial cash flows of the business. He estimates that there will not be any sales demand in January 2003 so production in that month will be used to build up stocks to satisfy the expected demand in February 2003. Thereafter it is intended to schedule production in order to build up sufficient finished goods stock at the end of each month to satisfy demand during the following month. Production will, however, need to be 5% higher than sales due to expected defects that will have to be scrapped. Defects are only discovered after the goods have been completed. The company will not hold stocks of raw materials or work in progress.

As the business is new, demand is uncertain, but Jack has estimated three possible levels of demand in 2003 as follows:

|

High demand |

Medium demand |

Low demand |

|

£ |

£ |

£ |

February |

22,000 |

20,000 |

19,000 |

March |

26,000 |

24,000 |

23,000 |

April |

30,000 |

28,000 |

27,000 |

May |

29,000 |

27,000 |

26,000 |

June |

35,000 |

33,000 |

32,000 |

Demand for July 2003 onwards is expected to be the same as June 2003. The probability of each level of demand occurring each month is as follows:

High 0.05; |

Medium 0.85; |

Low 0.10. |

It is expected that 10% of the total sales value will be cash sales, mainly being retail customers making small purchases. The remaining 90% of sales will be made on two months’ credit. A 2·5% discount will, however, be offered to credit customers settling within one month. It is estimated that customers, representing half of credit sales by value, will take advantage of the discount while the remainder will take the full two months to pay.

Variable production costs (excluding costs of rejects) per £1,000 of sales are as follows:

|

£ |

Labour |

300 |

Materials |

200 |

Variable overhead |

100 |

Labour is paid in the month in which labour costs are incurred. Materials are paid one month in arrears and variable overheads are paid two months in arrears. Fixed production and administration overheads, excluding depreciation, are £7,000 per month and are payable in the same month as the expenditure is incurred.

Jack employed a firm of consultants to give him initial business advice. Their fee of £12,000 will be paid in February 2003. Smelting machinery will be purchased on 1 January 2003 for £200,000 payable in February 2003. Further machinery will be purchased for £50,000 in March 2003 payable in April 2003. This machinery is highly specialized and will have a low net realisable value after purchase.

Jack has redundancy money from his previous employment and savings totalling £150,000, which he intends to pay into his bank account on 1 January 2003 as the initial capital of the business. He realises that this will be insufficient for his business plans, so he is intending to approach his bank for finance in the form of both a fixed term loan and an overdraft. The only asset Jack has is his house that is valued at £200,000, but he has an outstanding mortgage of £80,000 on this property.

The consultants advising Jack have recommended that rather than accumulating sufficient stock to satisfy the following month’s demand he should not maintain any stock levels but merely produce sufficient in each month to meet the expected demand for that month.

Jack’s production manager objected: ‘I need to set up my production schedule based on the expected average demand for the month. I will reduce production in the month if it seems demand is low. However, there is no way production can be increased during the month to accommodate demand if it happens to be at the higher level that month. As a result, under this new system, there would be no stocks to fall back on and the extra sales, when monthly demand is high, would be lost, as customers require immediate delivery.’ In respect of this, an assessment of the impact of the introduction of just-in-time stock management on cash flows has been made that showed the following:

Required:

(a) Prepare a monthly cash budget for Jack Geep’s business for the six month period ending 30 June 2003. Calculations should be made on the basis of the expected values of sales. The cash budget should show the net cash inflow or outflow in each month and the cumulative cash surplus or deficit at the end of each month. For this purpose ignore bank finance and the suggested use of just-in-time stock management. (17 marks)

(b) Assume now that just-in-time stock management is used in accordance with the recommendations of the consultants. Calculate for EACH of the six months ending 30 June 2003:

(i) receipts from sales; and

(ii) payments to labour. (6 marks)

(c) Evaluate the impact for Jack Geep of introducing just-in-time stock management. This should include an assessment of the wider implications of just-in-time stock management in the particular circumstances of Jack Geep’s business. (10 marks)

(d) Write a report to Jack Geep which identifies the financing needs of the company. It should consider the following:

(i) the extent of financing required;

(ii) the factors that should be considered in determining the most appropriate mix of short-term financing (e.g. overdraft) and long-term financing (e.g. fixed term bank loan); and

(iii) the extent to which improved working capital management (other than just-in-time stock management) might reduce the company’s financing needs and describe how this might be achieved. Where appropriate, show supporting calculations.

(17 marks)

(50 marks)

Question 17 – Overtrading, factoring and lease or buy

At a recent meeting of the Board of Doe Ltd, a supplier of industrial and commercial clothing, it was suggested that the company might be suffering liquidity problems as a result of overtrading, despite encouraging growth in turnover. The Finance Director was instructed to report to the next Board meeting on this matter.

Extracts from the financial statements of Doe Ltd for 2002, and from the forecast financial statements for 2003, are given below.

Income statement extracts for years ending 31 December

Statement of financial position extracts as at 31 December

The Finance Director had reported to the recent board meeting that the bank was insisting the company reduce its overdraft as a matter of urgency. It was suggested that the company could consider factor finance as an alternative source of funds for working capital investment. The Production Director insisted that a new machine would be needed to maintain growth in turnover and the Finance Director agreed to investigate how this might be financed.

Factoring

The Finance Director has found a factor who would take over administration of the company’s debtors on a non-recourse basis for an annual fee of 1·0% of turnover. The factor would advance 80% of the book value of debtors at an annual interest rate 2% above the company’s current overdraft rate. The factor expects to reduce the average debtor period to 90 days. The company estimates that Doe Ltd could save £15,000 per year in administration costs. No redundancy costs are expected.

The New Machine

The new machine wanted by the Production Director would cost £365,000 if purchased. The Finance Director is confident this purchase could be financed by a medium-term bank loan at an annual interest cost of 10% before tax.

Alternatively, the machine could be leased for £77,250 per annum, payable annually in advance. The machine has an expected life of five years, at the end of which it would have zero scrap value.

Sales and Costs of New Machine Output

The Finance Director has commissioned research that shows growth in sales of the output produced by the new machine depends on the sales price, as follows:

Variable costs of production are £42 per unit and incremental fixed production overheads arising from the use of the machine are expected to be £85,000 per annum. The maximum capacity of the new machine is 20,000 units per annum.

Other Information

Doe Ltd pays tax one year in arrears at a rate of 30% and can claim annual writing down allowances (tax-allowable depreciation) on a 25% reducing balance basis. The company pays interest on its overdraft at approximately 6% per annum before tax.

Average ratios for the business sector in which Doe Ltd operates are as follows:

Stock days |

210 days |

Current ratio |

1.35 |

Debtor days |

100 days |

Quick ratio |

0.55 |

Creditor days |

120 days |

|

|

Required:

(a) Write a report to the board of Doe Ltd that analyses and discusses the suggestion that the company is overtrading. (12 marks)

(b) (i) Determine whether Doe Ltd should accept the factor’s offer. (7 marks)

(ii) What are the advantages to Doe Ltd of factoring its debtors? (8 marks)

(c) Discuss three ways (other than factoring) by which Doe Ltd might improve the management of its debtors. (8 marks)

(d) Evaluate whether Doe Ltd should buy or lease the new machine, using an after tax discount rate of 7%. (Assume that payment for the purchase, or the first lease payment, would take place on 1 January 2004.) (9 marks)

(e) Calculate the optimum sales price for the output from the new machine. (Taxation and the time value of money should be ignored.) (6 marks)

(50 marks)

Question 18 – Key Factors for the level of investment in current assets, calculation of OD, Factoring, invoicing discounting and EOQ

FLG Co has annual credit sales of $4·2 million and cost of sales of $1·89 million. Current assets consist of inventory and accounts receivable. Current liabilities consist of accounts payable and an overdraft with an average interest rate of 7% per year. The company gives two months’ credit to its customers and is allowed, on average, one month’s credit by trade suppliers. It has an operating cycle of three months.

Other relevant information:

Current ratio of FLG Co 1·4

Cost of long-term finance of FLG Co 11%

Required:

(a) Discuss the key factors which determine the level of investment in current assets.

(6 marks)

(b) Discuss the ways in which factoring and invoice discounting can assist in the management of accounts receivable. (6 marks)

(c) Calculate the size of the overdraft of FLG Co, the net working capital of the company and the total cost of financing its current assets. (6 marks)

(d) FLG Co wishes to minimise its inventory costs. Annual demand for a raw material costing $12 per unit is 60,000 units per year. Inventory management costs for this raw material are as follows:

Ordering cost: $6 per order

Holding cost: $0·5 per unit per year

The supplier of this raw material has offered a bulk purchase discount of 1% for orders of 10,000 units or more. If bulk purchase orders are made regularly, it is expected that annual holding cost for this raw material will increase to $2 per unit per year.

Required:

(i) Calculate the total cost of inventory for the raw material when using the economic order quantity. (4 marks)

(ii) Determine whether accepting the discount offered by the supplier will minimise the total cost of inventory for the raw material. (3 marks)

(Total 25 marks)

Source: https://hkiaatevening.yolasite.com/resources/QPMBNotes/Ch16-WCMgt.doc

Web site to visit: https://hkiaatevening.yolasite.com

Author of the text: indicated on the source document of the above text

If you are the author of the text above and you not agree to share your knowledge for teaching, research, scholarship (for fair use as indicated in the United States copyrigh low) please send us an e-mail and we will remove your text quickly. Fair use is a limitation and exception to the exclusive right granted by copyright law to the author of a creative work. In United States copyright law, fair use is a doctrine that permits limited use of copyrighted material without acquiring permission from the rights holders. Examples of fair use include commentary, search engines, criticism, news reporting, research, teaching, library archiving and scholarship. It provides for the legal, unlicensed citation or incorporation of copyrighted material in another author's work under a four-factor balancing test. (source: http://en.wikipedia.org/wiki/Fair_use)

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

The texts are the property of their respective authors and we thank them for giving us the opportunity to share for free to students, teachers and users of the Web their texts will used only for illustrative educational and scientific purposes only.

All the information in our site are given for nonprofit educational purposes