Chapter 07

Reporting and Interpreting Cost of Goods Sold and Inventory

True / False Questions

1. Ownership of goods passes from the seller to the buyer after the buyer has paid for the goods.

True False

2. If transportation costs are the responsibility of the buyer, they should be added to the cost of inventory purchases for the period.

True False

3. The weighted average method of inventory costing results in a valuation between that determined by the FIFO and LIFO costing methods.

True False

4. When the weighted average inventory method is used, ending inventory and cost of goods sold are valued at a different cost per unit.

True False

5. LIFO will always result in highest income when costs are rising in comparison to specific identification, FIFO and weighted average.

True False

6. LIFO can be used for income tax purposes and FIFO can be used for financial reporting purposes for a company in a given year.

True False

7. A large retail department store probably would use the specific identification inventory costing method for most of the items in its inventory.

True False

8. The lower-of-cost-or-market (LCM) rule is used because of the conservatism constraint, which allows a departure from the historical cost principle.

True False

9. If Dell Computer has 10,000 Pentium disks in stock at a cost of $300 per chip when they can be purchased at a replacement cost of $250 each. Dell will recognize this decline in cost when the chips are sold as part of their computers.

True False

10. Inventory turnover is computed as cost of goods sold divided by ending inventory.

True False

11. Reducing inventory can free up cash and allow for reduced borrowing.

True False

12. If a company sells their inventory every 87 days then their inventory turnover ratio must be 4.2 times.

True False

13. If a company has a decrease in inventory equal to $3 million and a decrease in accounts payable of $2 million, then cash flow from operating activities will increase by $1 million.

True False

14. The LIFO Reserve is a contra-asset account for the excess of FIFO inventory costs over the LIFO inventory costs.

True False

15. In a period of rising costs, the LIFO Reserve account would be deducted from the ending inventory under LIFO costing to convert it to ending inventory under FIFO costing.

True False

16. The beginning inventory of one accounting period becomes the beginning inventory amount of the next accounting period.

True False

17. An understatement error in the ending inventory causes an overstatement of both net income and current assets in that year.

True False

18. When a company using LIFO costing reduces its inventory levels at the end of the year, it can lead to a LIFO liquidation.

True False

19. When a perpetual inventory system is used, the purchases returns and allowances account will not be part of the general ledger accounts.

True False

20. Under the periodic inventory system, the balance in the inventory account changes each time a purchase or sale of inventory is recorded.

True False

Multiple Choice Questions

21. Which of the following best describes inventory?

A. They are held for resale.

B. They are tangible property.

C. They are used in the operations of the company.

D. They are held for resale and are tangible property.

22. Which of the following statements about inventory is true?

A. It is acquired for use in operating the company.

B. It is intangible property.

C. It is a current asset on the balance sheet.

D. Manufacturers have four inventory accounts.

23. Rockwell Company reported the following amounts on its 2009 income statement: Purchases, $100,000; Beginning inventory, $20,000; and Cost of goods sold, $110,000. Therefore, the 2009 ending inventory was

A. $10,000.

B. $25,000.

C. $15,000.

D. $27,000.

24. The 2009 records of Coleman Company showed beginning inventory, $100,000; cost of goods sold, $450,000; and ending inventory, $80,000. The purchases for 2009 equal

A. $450,000.

B. $410,000.

C. $430,000.

D. $420,000.

25. When goods are sold on credit, revenue usually should be recognized at the date of

A. receipt of the sales order.

B. passage of title from the seller to the buyer.

C. receipt of the goods by the buyer.

D. manufacture of the goods.

26. Which of the following types of inventory usually is not held by a manufacturing business?

A. Finished goods inventory

B. Raw material inventory

C. Merchandise inventory

D. Work in process inventory

27. Which of the following is true about a manufacturing company's inventory?

A. Components purchased from vendors will be added to a raw material inventory account.

B. Direct labor and factory overhead are added to the materials in the raw material inventory account.

C. Cost of storing finished units in a separate warehouse will be added to the finished goods inventory account.

D. Direct labor and factory overhead are subtracted from the materials in the raw material inventory account.

28. Thorton Co. reported the following data at year-end. Sales, $500,000; beginning inventory, $40,000; ending inventory, $45,000; cost of goods sold, $350,000; and gross margin, $150,000. What was the amount of merchandise purchased during the year?

A. $370,000

B. $355,000

C. $348,000

D. $341,000

29. The following information was taken from the 2010 income statement of Cobra Company: Pretax income, $12,000; Total operating expenses (not including income taxes), $20,000; Sales revenue, $120,000. Compute cost of goods sold.

A. $ 88,000

B. $100,000

C. $108,000

D. $112,000

30. The following information was taken from the 2010 income statement of Milburn Company: Pretax income, $12,000; Total operating expenses (not including income taxes), $20,000; Sales revenue, $120,000; Beginning inventory, $8,000; and Purchases, $90,000. Compute the amount of the ending inventory.

A. $88,000

B. $10,000

C. $ 8,000

D. $18,000

31. Which of the following is true?

A. Factory overhead consists of manufacturing costs other than direct materials and direct labor.

B. Net realizable value is the expected sales price plus selling costs.

C. LIFO Reserve is a contra sales account for the excess of LIFO over FIFO inventory.

D. Purchases discounts increase sales revenue to arrive at net sales.

32. Sheffield Company had the following information taken from its 2009 adjusted trial balance: Sales, $400,000; Sales Discounts, $12,000; Beginning Inventory, $20,000; and Purchases, $200,000. Ending inventory was determined to be $25,000. Compute the gross margin (gross profit) that would appear in the income statement.

A. $162,000.

B. $180,000.

C. $193,000.

D. $205,000.

33. On March 10, Anthony Company received merchandise for resale from its normal supplier. The price was $3,600 with terms of 2/10, n/30 for 100 units of Part #345. The invoice was paid on March 17. Freight costs were $120 and the company paid $108 of interest on a loan to buy the inventory. What is the unit cost that should be recorded for each of the 100 units of Part # 345?

A. $36.48

B. $37.20

C. $36.00

D. $37.56

34. Which of the following is correct?

A. Beginning Inventory + Purchases - Cost of Goods Sold = Ending Inventory.

B. Sales + Cost of Goods Sold = Gross Margin.

C. Beginning Inventory + Ending Inventory - Purchases = Cost of Goods Sold.

D. Income Before Taxes - Operating Expenses = Cost of Goods Sold.

35. Which of the following costs while includable in inventory, is usually expensed as incurred instead of being assigned to the inventory units?

A. Freight costs

B. Inspection and preparation costs

C. Purchases discounts

D. Purchase returns

36. Which of the following costs would not be part of product inventory costs for a manufacturer such as Harley Davidson?

A. Costs to advertise the newest model.

B. Kickstands purchased for use in manufacturing the motorcycles

C. The factory manager's salary and benefits

D. The wages and benefits of an employee in the welding department

37. Which of the following businesses would not have cost of goods sold?

A. A jewelry store

B. A grocery store

C. A law firm

D. A manufacturer of batteries

38. Which of the following inventory costing methods is subject to manipulation with regard to the resulting inventory cost?

A. LIFO.

B. FIFO.

C. Weighted-average cost.

D. All of the inventory methods are subject to manipulation.

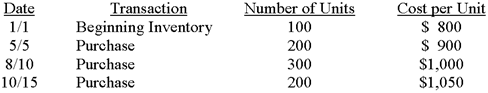

39. Lauer Corporation uses the periodic inventory system and the following information about their laptop computer is available:

During the year, 750 laptop computers were sold.

What was ending inventory and cost of goods sold on 12/31 under the FIFO cost flow assumption?

A. $60,000 and $710,000.

B. $52,500 and $717,500.

C. $52,000 and $718,000.

D. None of the answers is correct.

40. Lauer Corporation uses the periodic inventory system and the following information about their laptop computer is available:

During the year, 750 laptop computers were sold.

What was ending inventory and cost of goods sold on 12/31 under the LIFO cost flow assumption?

A. $56,000 and $714,000.

B. $45,000 and $725,000.

C. $40,000 and $730,000.

D. None of the answers is correct.

41. Under the FIFO cost flow assumption during a period of inflation, which of the following is false?

A. Income tax expense will be higher than under LIFO.

B. Gross margin will be higher than under LIFO.

C. Ending inventory will be lower than under LIFO.

D. Cost of goods sold will be lower than under LIFO.

42. Under the LIFO cost flow assumption during a period of inflation, which of the following is false?

A. Cost of goods sold will be lower than under FIFO.

B. Gross margin will be lower than under FIFO.

C. Income tax expense will be lower than under FIFO.

D. Ending inventory will be lower than under FIFO.

43. When prices are rising:

A. LIFO will result in lower net income and a higher inventory valuation than will FIFO.

B. LIFO will result in higher net income and lower inventory valuation than will FIFO.

C. FIFO will result in lower net income and a lower inventory valuation than will LIFO.

D. FIFO will result in higher net income and a higher inventory valuation than will LIFO.

44. When prices are rising, the method of inventory valuation that results in the highest relative net cash inflow is:

A. FIFO.

B. LIFO.

C. weighted average.

D. inventory methods cannot affect cash flows.

45. Which of the following statements is correct?

A. FIFO reports lower income amounts than LIFO when prices are rising.

B. LIFO reports a higher income amount than FIFO when prices are rising.

C. LIFO reports a higher income amount than FIFO when prices are decreasing.

D. LIFO reports the same amount of income as FIFO when prices are rising.

46. Which of the following statements is true?

A. Applying the lower of cost or market (LCM) rule is optional and depends on whether a company wants to write off inventory when it loses its value or prefers to delay the write off until the inventory is sold.

B. The LIFO conformity rule requires use of LIFO for financial reports if it is adopted for tax purposes.

C. LIFO liquidation occurs when a company switches from LIFO to another cost method.

D. The LIFO conformity rule requires use of LIFO for taxes if it is adopted for financial reports.

47. The LIFO costing method is more costly and time consuming than a FIFO system. Which of the following would be a valid justification for choosing LIFO?

A. It usually provides for more control over inventory

B. It usually provides managers with more useful information about the level of inventory by monitoring the cost level in the inventory account

C. The tax savings from using LIFO during an inflationary period exceeds the cost of using a LIFO costing system

D. It usually produces a higher net income when unit costs of inventory are rising

48. Moore Company purchased an item for inventory that cost $20 per unit and was marked to sell at $30. It was determined that the replacement cost is $18 per unit. No purchases in the near future are anticipated. Using the lower-of-cost-or- market rule, the per unit valuation for inventory should be

A. $18.00.

B. $20.00.

C. $25.00.

D. $30.00.

49. On December 31, 2009, the end of the accounting period, Cruise Company has on hand 10,000 units of a resale item which cost $40 per unit when purchased on June 15, 2009. The selling price is $70 per unit. On December 30, 2009, the cost had dropped to $38 per unit. In view of the large quantity of units on hand, no purchases are anticipated in the next six to nine months. At what inventory amount should the 10,000 units be reported?

A. $100,000.

B. $120,000.

C. $350,000.

D. $380,000.

50. Under the lower-of-cost-or-market basis for valuing inventory if replacement cost of an item in inventory has declined during a given accounting period,

A. pretax income and the amount of ending inventory will be reduced for the period in which the merchandise is sold.

B. pretax income and the amount of ending inventory will be reduced for the period during which the decline in market value occurred.

C. pretax income will be reduced for the period during which the decline in market value occurred and the amount of ending inventory will decline for the period in which the merchandise is sold.

D. pretax income will be reduced for the period during which the merchandise is sold and the amount of ending inventory will decline for the period in which the decline in market value occurred

51. Which of the following is a true statement about lower of cost or market (LCM)?

A. It is optional under generally accepted accounting principles, whether you apply LCM in the year in which net realizable value declines below cost or the company waits until the inventory is sold.

B. LCM can be applied to all cost methods under generally accepted accounting principles except for LIFO.

C. For tax purposes, the LIFO cost flow method cannot have LCM applied.

D. Under LCM, market equals the current selling price to the retail customer.

52. Tinker's Toys had cost of goods sold in 2009 of $7,506 million and $7,646 million in 2008. Their merchandise inventory at the end of 2009 was $1,884 million and $2,094 million at the end of 2008. What was their inventory turnover in 2009?

A. 3.77

B. 3.89

C. 3.97

D. 3.58

53. Tinker's Toys had cost of goods sold in 2009 of $7,506 million and $7,646 million in 2008. Their merchandise inventory in 2009 was $1,884 million and $2,094 million in 2008. How long were their average days to sell inventory in 2009?

A. 104.52 days

B. 100.31 days

C. 96.82 days

D. 101.96 days

54. A company reports its 2010 cost of goods sold at $15.0 million. Its ending inventory for 2010 is $1.6 million and for 2009, ending inventory was $1.2 million. How much inventory did the company purchase during 2009?

A. $14.6 million

B. $15.0 million

C. $15.4 million

D. $15.8 million

55. A company recorded net purchases on credit of $15.7 million for 2010. In 2009, ending accounts payable was $1.4 million and in 2010, it was $1.9 million. How much cash was paid to suppliers in 2010?

A. $14.8 million

B. $15.0 million

C. $15.2 million

D. $15.7 million

56. A company reports its cost of goods sold as $15.0 billion in 2009. It has $2.9 billion in inventory and reports accounts payable at $1.2 billion at the end of 2009. At the end of 2008 ending inventory was reported at $3.1 billion and accounts payable was $1.4 billion. How much cash was paid to suppliers for 2009?

A. $14.8 billion

B. $15.0 billion

C. $15.2 billion

D. $15.7 billion

57. In 2010, QV-TV, Inc. provided the following items in their footnotes. Their cost of goods sold was $22 billion under FIFO costing and their inventory value under FIFO costing was $2.1 billion. Their LIFO Reserve figure for year end 2009 was a $0.6 billion credit balance and at year end 2010 it had increased to a credit balance of $0.8 billion. How much is LIFO inventory value at year end 2010?

A. $1.9 billion

B. $2.9 billion

C. $2.3 billion

D. $1.3 billion

58. In 2010, Terry Inc. provided the following items in their footnotes. Their cost of goods sold was $22 billion under FIFO costing and their inventory value under FIFO costing was $2.1 billion. Their LIFO Reserve account balance for year end 2009 had a $0.6 billion credit balance and then at year end 2010, it had a credit balance of $0.8 billion. How much would they report as LIFO cost of goods sold?

A. $22.2 billion

B. $19.8 billion

C. $22.8 billion

D. $19.2 billion

59. Which of the following statements is false?

A. The LIFO Reserve is a contra-asset account for the excess of FIFO over LIFO inventory costs.

B. When the LIFO Reserve account increases from one year to the next, then FIFO cost of goods sold will be less than LIFO cost of goods sold.

C. The LIFO Reserve account balance at the end of the year would be deducted from ending LIFO inventory cost to convert to FIFO ending inventory cost.

D. We want to convert LIFO cost of goods sold and LIFO inventory balances to FIFO cost of goods sold and inventory balances to obtain a more realistic inventory turnover ratio.

60. A $25,000 overstatement of the 2010 ending inventory was discovered after the financial statements for 2010 were prepared. The effect of the inventory error on the 2010 financial statements was

A. current assets were overstated and net income was understated.

B. current assets were understated and net income was understated.

C. current assets were overstated and net income was overstated.

D. current assets were understated and net income was overstated.

61. Wilmington Company reported pretax income amounts of: 2010, $25,000; and 2011, $30,000. Later it was discovered that the ending inventory for 2010 was understated by $2,000 (and not corrected in 2011). The correct pretax income for each year was:

![]()

A. ![]()

B. ![]()

C. ![]()

D. ![]()

62. At the end of 2009, a $5,000 understatement was discovered in the amount of the 2009 ending inventory as reflected in the perpetual inventory records. What were the 2009 effects of the $5,000 inventory error (before correction)?

A. Assets (inventory) were understated by $5,000 and pretax income was understated by $5,000.

B. Assets (inventory) were understated by $5,000 and pretax income was overstated by $5,000.

C. Cost of goods sold was understated by $5,000 and pretax income was understated by $5,000.

D. Cost of goods sold was overstated by $5,000 and pretax income was overstated by $5,000.

63. An understatement of the ending inventory in Year 1, if not corrected, will cause

A. Year 1 net income to be understated and Year 2 net income to be overstated.

B. Year 1 net income to be overstated and Year 2 net income to be overstated.

C. Year 1 net income to be overstated and Year 2 net income will be correct.

D. Year 1 net income to be overstated and Year 2 net income to be understated.

64. If beginning inventory is understated by $1,300 and ending inventory is understated by $700, pretax income for the period will be:

A. understated by $600.

B. understated by $2,000.

C. overstated by $600.

D. overstated by $2,000.

65. On December 15, 2009, Transport Company accepted delivery of merchandise which it purchased on credit. As of December 31, 2009, the company had neither recorded the transaction nor included the merchandise in its ending inventory amount because the seller's invoice had not been received. The effect of this omission on its balance sheet at December 31, 2009, (end of the accounting period) was that

A. assets and stockholder's equity were overstated but liabilities were not affected.

B. stockholder's equity was the only item affected by the omission.

C. assets and liabilities were understated but stockholders' equity was not affected.

D. assets and stockholders' equity were understated but liabilities were not affected.

66. A company using the periodic inventory system correctly recorded a purchase of merchandise, but the merchandise was not included in the physical inventory count at the end of the accounting period. The error caused an:

A. understatement of both net income and assets.

B. overstatement of inventory, purchases, and accounts payable.

C. understatement of inventory, purchases, and accounts payable.

D. overstatement of net income and assets.

67. At the end of 2010, XYZ Company failed to include some goods in its ending inventory and failed to record the purchase of these goods. For 2010, these two errors caused

A. goods available for sale, cost of goods sold, and income to be overstated.

B. ending inventory, cost of goods sold, and retained earnings to be understated.

C. ending inventory, goods available for sale, and retained earnings to be understated.

D. no effect on income, working capital, or retained earnings.

68. Hollander Company hired some students to help count inventory during their semester break. Unfortunately, the students added incorrectly and ending inventory was overstated by $5,000. What would be the effect of this error in ending inventory?

A. Income would be overstated.

B. Income would be understated.

C. Ending retained earnings would be understated.

D. Cost of goods sold would be overstated.

69. During the audit of Montane Company's 2010 financial statements, the auditors discovered that the 2010 ending inventory had been overstated by $8,000. Before the effect of this error, 2010 pretax income had been computed as $100,000. What should be reported as the correct 2010 pretax income before taxes?

A. $ 92,000.

B. $100,000.

C. None of the other answers is correct.

D. $108,000.

70. Under the periodic method, cost of goods sold is computed by

A. adding the cost of purchases during the period to the cost of the inventory on hand at the beginning of the period and adding this figure to the cost of the inventory on hand at the end of the period.

B. adding the cost of purchases during the period to the cost of the inventory on hand at the end of the period and subtracting the inventory on hand at the beginning of the period.

C. subtracting the cost of the inventory on hand at the ending of the period from the cost of goods available for sale.

D. carefully matching selling and administrative expenses with the sales to which they are related and then reporting these expenses in the same period the associated revenue is reported.

71. Under the perpetual inventory system:

A. one entry is required to record a sales return.

B. cost of goods sold cannot be determined unless a physical inventory is taken.

C. one entry is required to record a sale.

D. a separate account for purchases is not required.

72. Under the periodic inventory system:

A. a transaction by transaction unit inventory record is maintained.

B. the cost of goods sold for each sale is recorded at the time each sale is made.

C. a separate account for purchases is used.

D. a continuous inventory record provides the amount of ending inventory and the cost of goods sold throughout the period.

73. Which of the following may be used to calculate ending inventory (EI) under the periodic inventory system?

A. BI + P + CGS = EI.

B. BI + P - CGS = EI.

C. BI - P + CGS = EI.

D. BI + P + GM = EI.

74. On March 15, 2009, Ryan Company purchased $10,000 of merchandise on credit subject to terms, 2/10, n/30. Ryan Company records its purchases using the gross amount. The periodic inventory system is used. If Ryan Company pays for these goods on March 30, the entry made to record the payment should include

A. $200 credit to Purchase discounts.

B. debit of $9,800 to Accounts payable.

C. debit of $10,000 to Accounts payable.

D. $9,800 credit to cash.

75. Two systems are used in accounting for inventory—perpetual and periodic. Which of the following statements is correct?

A. In a perpetual inventory system, the inventory account is not changed for each purchase during the accounting period.

B. In a perpetual inventory system, cost of goods sold is recorded at the time of each sale during the accounting period.

C. In a periodic inventory system, cost of goods sold is developed from a comparison of beginning inventory and ending inventory only.

D. In a periodic inventory system, the inventory account is increased for each purchase during the accounting period.

76. Which one of the following statements concerning the periodic and perpetual inventory systems is true?

A. The periodic system uses a purchases account.

B. Inventory controls are only needed for the periodic inventory systems.

C. None of the accounting entries vary between the two systems.

D. Due to advances in computers, many businesses recently have begun to use the periodic inventory system.

77. When a company uses the periodic inventory system in accounting for its merchandise inventory, which of the following is true?

A. Purchases are recorded in the cost of goods sold account.

B. The inventory account is updated after each sale.

C. Cost of goods sold is computed at the end of the accounting periods rather than at each sale.

D. The inventory account is updated throughout the year as purchases are made.

78. A LIFO liquidation occurs when a company

A. goes out of business.

B. converts from LIFO to FIFO.

C. converts from the periodic to the perpetual inventory system.

D. sells more units than it purchased during the year.

79. Carrie Company sold merchandise with an invoice price of $1,000 to Underwood, Inc., with terms of 2/10, n/30. Which of the following is the correct entry to record the payment by Underwood Inc., within the 10 days if the company uses the periodic inventory system and the gross method to record purchases?

A.

B.

C. ![]()

D. ![]()

80. On September 20, 2009, Precision Electric Company purchased $10,000 of stereo equipment for resale on credit, subject to the terms 2/15, n/30. The periodic inventory system is used. If the company paid for these goods on October 18, the entry made to record the payment should include a/an

A. $200 debit to Purchases discounts.

B. $10,000 debit to Accounts payable.

C. $9,800 credit to Cash.

D. $10,000 debit to Purchases.

Chapter 07 Reporting and Interpreting Cost of Goods Sold and Inventory Answer Key

True / False Questions

1. Ownership of goods passes from the seller to the buyer after the buyer has paid for the goods.

FALSE

AACSB Tag: Reflective Thinking

Difficulty: Easy

Learning Objective: 1

2. If transportation costs are the responsibility of the buyer, they should be added to the cost of inventory purchases for the period.

TRUE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 1

3. The weighted average method of inventory costing results in a valuation between that determined by the FIFO and LIFO costing methods.

TRUE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 2

4. When the weighted average inventory method is used, ending inventory and cost of goods sold are valued at a different cost per unit.

FALSE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 2

5. LIFO will always result in highest income when costs are rising in comparison to specific identification, FIFO and weighted average.

FALSE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 2

6. LIFO can be used for income tax purposes and FIFO can be used for financial reporting purposes for a company in a given year.

FALSE

AACSB Tag: Communications

Difficulty: Hard

Learning Objective: 3

7. A large retail department store probably would use the specific identification inventory costing method for most of the items in its inventory.

FALSE

AACSB Tag: Reflective Thinking

Difficulty: Easy

Learning Objective: 3

8. The lower-of-cost-or-market (LCM) rule is used because of the conservatism constraint, which allows a departure from the historical cost principle.

TRUE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 4

9. If Dell Computer has 10,000 Pentium disks in stock at a cost of $300 per chip when they can be purchased at a replacement cost of $250 each. Dell will recognize this decline in cost when the chips are sold as part of their computers.

FALSE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 4

10. Inventory turnover is computed as cost of goods sold divided by ending inventory.

FALSE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 5

11. Reducing inventory can free up cash and allow for reduced borrowing.

TRUE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 5

12. If a company sells their inventory every 87 days then their inventory turnover ratio must be 4.2 times.

TRUE

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 5

13. If a company has a decrease in inventory equal to $3 million and a decrease in accounts payable of $2 million, then cash flow from operating activities will increase by $1 million.

TRUE

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 5

14. The LIFO Reserve is a contra-asset account for the excess of FIFO inventory costs over the LIFO inventory costs.

TRUE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 6

15. In a period of rising costs, the LIFO Reserve account would be deducted from the ending inventory under LIFO costing to convert it to ending inventory under FIFO costing.

FALSE

AACSB Tag: Reflective Thinking

Difficulty: Hard

Learning Objective: 6

16. The beginning inventory of one accounting period becomes the beginning inventory amount of the next accounting period.

FALSE

AACSB Tag: Reflective Thinking

Difficulty: Easy

Learning Objective: 7

17. An understatement error in the ending inventory causes an overstatement of both net income and current assets in that year.

FALSE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 7

18. When a company using LIFO costing reduces its inventory levels at the end of the year, it can lead to a LIFO liquidation.

TRUE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: Sup A

19. When a perpetual inventory system is used, the purchases returns and allowances account will not be part of the general ledger accounts.

TRUE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: Sup B

20. Under the periodic inventory system, the balance in the inventory account changes each time a purchase or sale of inventory is recorded.

FALSE

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: Sup C

Multiple Choice Questions

21. Which of the following best describes inventory?

A. They are held for resale.

B. They are tangible property.

C. They are used in the operations of the company.

D. They are held for resale and are tangible property.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 1

22. Which of the following statements about inventory is true?

A. It is acquired for use in operating the company.

B. It is intangible property.

C. It is a current asset on the balance sheet.

D. Manufacturers have four inventory accounts.

AACSB Tag: Reflective Thinking

Difficulty: Easy

Learning Objective: 1

23. Rockwell Company reported the following amounts on its 2009 income statement: Purchases, $100,000; Beginning inventory, $20,000; and Cost of goods sold, $110,000. Therefore, the 2009 ending inventory was

A. $10,000.

B. $25,000.

C. $15,000.

D. $27,000.

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 1

24. The 2009 records of Coleman Company showed beginning inventory, $100,000; cost of goods sold, $450,000; and ending inventory, $80,000. The purchases for 2009 equal

A. $450,000.

B. $410,000.

C. $430,000.

D. $420,000.

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 1

25. When goods are sold on credit, revenue usually should be recognized at the date of

A. receipt of the sales order.

B. passage of title from the seller to the buyer.

C. receipt of the goods by the buyer.

D. manufacture of the goods.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 1

26. Which of the following types of inventory usually is not held by a manufacturing business?

A. Finished goods inventory

B. Raw material inventory

C. Merchandise inventory

D. Work in process inventory

AACSB Tag: Reflective Thinking

Difficulty: Easy

Learning Objective: 1

27. Which of the following is true about a manufacturing company's inventory?

A. Components purchased from vendors will be added to a raw material inventory account.

B. Direct labor and factory overhead are added to the materials in the raw material inventory account.

C. Cost of storing finished units in a separate warehouse will be added to the finished goods inventory account.

D. Direct labor and factory overhead are subtracted from the materials in the raw material inventory account.

AACSB Tag: Reflective Thinking

Difficulty: Hard

Learning Objective: 1

28. Thorton Co. reported the following data at year-end. Sales, $500,000; beginning inventory, $40,000; ending inventory, $45,000; cost of goods sold, $350,000; and gross margin, $150,000. What was the amount of merchandise purchased during the year?

A. $370,000

B. $355,000

C. $348,000

D. $341,000

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 1

29. The following information was taken from the 2010 income statement of Cobra Company: Pretax income, $12,000; Total operating expenses (not including income taxes), $20,000; Sales revenue, $120,000. Compute cost of goods sold.

A. $ 88,000

B. $100,000

C. $108,000

D. $112,000

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 1

30. The following information was taken from the 2010 income statement of Milburn Company: Pretax income, $12,000; Total operating expenses (not including income taxes), $20,000; Sales revenue, $120,000; Beginning inventory, $8,000; and Purchases, $90,000. Compute the amount of the ending inventory.

A. $88,000

B. $10,000

C. $ 8,000

D. $18,000

AACSB Tag: Analytic

Difficulty: Hard

Learning Objective: 1

31. Which of the following is true?

A. Factory overhead consists of manufacturing costs other than direct materials and direct labor.

B. Net realizable value is the expected sales price plus selling costs.

C. LIFO Reserve is a contra sales account for the excess of LIFO over FIFO inventory.

D. Purchases discounts increase sales revenue to arrive at net sales.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 1

32. Sheffield Company had the following information taken from its 2009 adjusted trial balance: Sales, $400,000; Sales Discounts, $12,000; Beginning Inventory, $20,000; and Purchases, $200,000. Ending inventory was determined to be $25,000. Compute the gross margin (gross profit) that would appear in the income statement.

A. $162,000.

B. $180,000.

C. $193,000.

D. $205,000.

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 1

33. On March 10, Anthony Company received merchandise for resale from its normal supplier. The price was $3,600 with terms of 2/10, n/30 for 100 units of Part #345. The invoice was paid on March 17. Freight costs were $120 and the company paid $108 of interest on a loan to buy the inventory. What is the unit cost that should be recorded for each of the 100 units of Part # 345?

A. $36.48

B. $37.20

C. $36.00

D. $37.56

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 1

34. Which of the following is correct?

A. Beginning Inventory + Purchases - Cost of Goods Sold = Ending Inventory.

B. Sales + Cost of Goods Sold = Gross Margin.

C. Beginning Inventory + Ending Inventory - Purchases = Cost of Goods Sold.

D. Income Before Taxes - Operating Expenses = Cost of Goods Sold.

AACSB Tag: Reflective Thinking

Difficulty: Easy

Learning Objective: 1

35. Which of the following costs while includable in inventory, is usually expensed as incurred instead of being assigned to the inventory units?

A. Freight costs

B. Inspection and preparation costs

C. Purchases discounts

D. Purchase returns

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 1

36. Which of the following costs would not be part of product inventory costs for a manufacturer such as Harley Davidson?

A. Costs to advertise the newest model.

B. Kickstands purchased for use in manufacturing the motorcycles

C. The factory manager's salary and benefits

D. The wages and benefits of an employee in the welding department

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 1

37. Which of the following businesses would not have cost of goods sold?

A. A jewelry store

B. A grocery store

C. A law firm

D. A manufacturer of batteries

AACSB Tag: Reflective Thinking

Difficulty: Easy

Learning Objective: 1

38. Which of the following inventory costing methods is subject to manipulation with regard to the resulting inventory cost?

A. LIFO.

B. FIFO.

C. Weighted-average cost.

D. All of the inventory methods are subject to manipulation.

AACSB Tag: Reflective Thinking

Difficulty: Hard

Learning Objective: 2

39. Lauer Corporation uses the periodic inventory system and the following information about their laptop computer is available:

During the year, 750 laptop computers were sold.

What was ending inventory and cost of goods sold on 12/31 under the FIFO cost flow assumption?

A. $60,000 and $710,000.

B. $52,500 and $717,500.

C. $52,000 and $718,000.

D. None of the answers is correct.

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 2

40. Lauer Corporation uses the periodic inventory system and the following information about their laptop computer is available:

During the year, 750 laptop computers were sold.

What was ending inventory and cost of goods sold on 12/31 under the LIFO cost flow assumption?

A. $56,000 and $714,000.

B. $45,000 and $725,000.

C. $40,000 and $730,000.

D. None of the answers is correct.

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 2

41. Under the FIFO cost flow assumption during a period of inflation, which of the following is false?

A. Income tax expense will be higher than under LIFO.

B. Gross margin will be higher than under LIFO.

C. Ending inventory will be lower than under LIFO.

D. Cost of goods sold will be lower than under LIFO.

AACSB Tag: Reflective Thinking

Difficulty: Hard

Learning Objective: 2

42. Under the LIFO cost flow assumption during a period of inflation, which of the following is false?

A. Cost of goods sold will be lower than under FIFO.

B. Gross margin will be lower than under FIFO.

C. Income tax expense will be lower than under FIFO.

D. Ending inventory will be lower than under FIFO.

AACSB Tag: Reflective Thinking

Difficulty: Hard

Learning Objective: 2

43. When prices are rising:

A. LIFO will result in lower net income and a higher inventory valuation than will FIFO.

B. LIFO will result in higher net income and lower inventory valuation than will FIFO.

C. FIFO will result in lower net income and a lower inventory valuation than will LIFO.

D. FIFO will result in higher net income and a higher inventory valuation than will LIFO.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 3

44. When prices are rising, the method of inventory valuation that results in the highest relative net cash inflow is:

A. FIFO.

B. LIFO.

C. weighted average.

D. inventory methods cannot affect cash flows.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 3

45. Which of the following statements is correct?

A. FIFO reports lower income amounts than LIFO when prices are rising.

B. LIFO reports a higher income amount than FIFO when prices are rising.

C. LIFO reports a higher income amount than FIFO when prices are decreasing.

D. LIFO reports the same amount of income as FIFO when prices are rising.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 3

46. Which of the following statements is true?

A. Applying the lower of cost or market (LCM) rule is optional and depends on whether a company wants to write off inventory when it loses its value or prefers to delay the write off until the inventory is sold.

B. The LIFO conformity rule requires use of LIFO for financial reports if it is adopted for tax purposes.

C. LIFO liquidation occurs when a company switches from LIFO to another cost method.

D. The LIFO conformity rule requires use of LIFO for taxes if it is adopted for financial reports.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 3

47. The LIFO costing method is more costly and time consuming than a FIFO system. Which of the following would be a valid justification for choosing LIFO?

A. It usually provides for more control over inventory

B. It usually provides managers with more useful information about the level of inventory by monitoring the cost level in the inventory account

C. The tax savings from using LIFO during an inflationary period exceeds the cost of using a LIFO costing system

D. It usually produces a higher net income when unit costs of inventory are rising

AACSB Tag: Reflective Thinking

Difficulty: Hard

Learning Objective: 3

48. Moore Company purchased an item for inventory that cost $20 per unit and was marked to sell at $30. It was determined that the replacement cost is $18 per unit. No purchases in the near future are anticipated. Using the lower-of-cost-or- market rule, the per unit valuation for inventory should be

A. $18.00.

B. $20.00.

C. $25.00.

D. $30.00.

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 4

49. On December 31, 2009, the end of the accounting period, Cruise Company has on hand 10,000 units of a resale item which cost $40 per unit when purchased on June 15, 2009. The selling price is $70 per unit. On December 30, 2009, the cost had dropped to $38 per unit. In view of the large quantity of units on hand, no purchases are anticipated in the next six to nine months. At what inventory amount should the 10,000 units be reported?

A. $100,000.

B. $120,000.

C. $350,000.

D. $380,000.

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 4

50. Under the lower-of-cost-or-market basis for valuing inventory if replacement cost of an item in inventory has declined during a given accounting period,

A. pretax income and the amount of ending inventory will be reduced for the period in which the merchandise is sold.

B. pretax income and the amount of ending inventory will be reduced for the period during which the decline in market value occurred.

C. pretax income will be reduced for the period during which the decline in market value occurred and the amount of ending inventory will decline for the period in which the merchandise is sold.

D. pretax income will be reduced for the period during which the merchandise is sold and the amount of ending inventory will decline for the period in which the decline in market value occurred

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 4

51. Which of the following is a true statement about lower of cost or market (LCM)?

A. It is optional under generally accepted accounting principles, whether you apply LCM in the year in which net realizable value declines below cost or the company waits until the inventory is sold.

B. LCM can be applied to all cost methods under generally accepted accounting principles except for LIFO.

C. For tax purposes, the LIFO cost flow method cannot have LCM applied.

D. Under LCM, market equals the current selling price to the retail customer.

AACSB Tag: Reflective Thinking

Difficulty: Hard

Learning Objective: 4

52. Tinker's Toys had cost of goods sold in 2009 of $7,506 million and $7,646 million in 2008. Their merchandise inventory at the end of 2009 was $1,884 million and $2,094 million at the end of 2008. What was their inventory turnover in 2009?

A. 3.77

B. 3.89

C. 3.97

D. 3.58

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 5

53. Tinker's Toys had cost of goods sold in 2009 of $7,506 million and $7,646 million in 2008. Their merchandise inventory in 2009 was $1,884 million and $2,094 million in 2008. How long were their average days to sell inventory in 2009?

A. 104.52 days

B. 100.31 days

C. 96.82 days

D. 101.96 days

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 5

54. A company reports its 2010 cost of goods sold at $15.0 million. Its ending inventory for 2010 is $1.6 million and for 2009, ending inventory was $1.2 million. How much inventory did the company purchase during 2009?

A. $14.6 million

B. $15.0 million

C. $15.4 million

D. $15.8 million

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 5

55. A company recorded net purchases on credit of $15.7 million for 2010. In 2009, ending accounts payable was $1.4 million and in 2010, it was $1.9 million. How much cash was paid to suppliers in 2010?

A. $14.8 million

B. $15.0 million

C. $15.2 million

D. $15.7 million

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 5

56. A company reports its cost of goods sold as $15.0 billion in 2009. It has $2.9 billion in inventory and reports accounts payable at $1.2 billion at the end of 2009. At the end of 2008 ending inventory was reported at $3.1 billion and accounts payable was $1.4 billion. How much cash was paid to suppliers for 2009?

A. $14.8 billion

B. $15.0 billion

C. $15.2 billion

D. $15.7 billion

AACSB Tag: Analytic

Difficulty: Hard

Learning Objective: 5

57. In 2010, QV-TV, Inc. provided the following items in their footnotes. Their cost of goods sold was $22 billion under FIFO costing and their inventory value under FIFO costing was $2.1 billion. Their LIFO Reserve figure for year end 2009 was a $0.6 billion credit balance and at year end 2010 it had increased to a credit balance of $0.8 billion. How much is LIFO inventory value at year end 2010?

A. $1.9 billion

B. $2.9 billion

C. $2.3 billion

D. $1.3 billion

AACSB Tag: Analytic

Difficulty: Hard

Learning Objective: 6

58. In 2010, Terry Inc. provided the following items in their footnotes. Their cost of goods sold was $22 billion under FIFO costing and their inventory value under FIFO costing was $2.1 billion. Their LIFO Reserve account balance for year end 2009 had a $0.6 billion credit balance and then at year end 2010, it had a credit balance of $0.8 billion. How much would they report as LIFO cost of goods sold?

A. $22.2 billion

B. $19.8 billion

C. $22.8 billion

D. $19.2 billion

AACSB Tag: Analytic

Difficulty: Hard

Learning Objective: 6

59. Which of the following statements is false?

A. The LIFO Reserve is a contra-asset account for the excess of FIFO over LIFO inventory costs.

B. When the LIFO Reserve account increases from one year to the next, then FIFO cost of goods sold will be less than LIFO cost of goods sold.

C. The LIFO Reserve account balance at the end of the year would be deducted from ending LIFO inventory cost to convert to FIFO ending inventory cost.

D. We want to convert LIFO cost of goods sold and LIFO inventory balances to FIFO cost of goods sold and inventory balances to obtain a more realistic inventory turnover ratio.

AACSB Tag: Reflective Thinking

Difficulty: Hard

Learning Objective: 6

60. A $25,000 overstatement of the 2010 ending inventory was discovered after the financial statements for 2010 were prepared. The effect of the inventory error on the 2010 financial statements was

A. current assets were overstated and net income was understated.

B. current assets were understated and net income was understated.

C. current assets were overstated and net income was overstated.

D. current assets were understated and net income was overstated.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 7

61. Wilmington Company reported pretax income amounts of: 2010, $25,000; and 2011, $30,000. Later it was discovered that the ending inventory for 2010 was understated by $2,000 (and not corrected in 2011). The correct pretax income for each year was:

![]()

A. ![]()

B. ![]()

C. ![]()

D. ![]()

AACSB Tag: Analytic

Difficulty: Hard

Learning Objective: 7

62. At the end of 2009, a $5,000 understatement was discovered in the amount of the 2009 ending inventory as reflected in the perpetual inventory records. What were the 2009 effects of the $5,000 inventory error (before correction)?

A. Assets (inventory) were understated by $5,000 and pretax income was understated by $5,000.

B. Assets (inventory) were understated by $5,000 and pretax income was overstated by $5,000.

C. Cost of goods sold was understated by $5,000 and pretax income was understated by $5,000.

D. Cost of goods sold was overstated by $5,000 and pretax income was overstated by $5,000.

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 7

63. An understatement of the ending inventory in Year 1, if not corrected, will cause

A. Year 1 net income to be understated and Year 2 net income to be overstated.

B. Year 1 net income to be overstated and Year 2 net income to be overstated.

C. Year 1 net income to be overstated and Year 2 net income will be correct.

D. Year 1 net income to be overstated and Year 2 net income to be understated.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 7

64. If beginning inventory is understated by $1,300 and ending inventory is understated by $700, pretax income for the period will be:

A. understated by $600.

B. understated by $2,000.

C. overstated by $600.

D. overstated by $2,000.

AACSB Tag: Analytic

Difficulty: Hard

Learning Objective: 7

65. On December 15, 2009, Transport Company accepted delivery of merchandise which it purchased on credit. As of December 31, 2009, the company had neither recorded the transaction nor included the merchandise in its ending inventory amount because the seller's invoice had not been received. The effect of this omission on its balance sheet at December 31, 2009, (end of the accounting period) was that

A. assets and stockholder's equity were overstated but liabilities were not affected.

B. stockholder's equity was the only item affected by the omission.

C. assets and liabilities were understated but stockholders' equity was not affected.

D. assets and stockholders' equity were understated but liabilities were not affected.

AACSB Tag: Reflective Thinking

Difficulty: Hard

Learning Objective: 7

66. A company using the periodic inventory system correctly recorded a purchase of merchandise, but the merchandise was not included in the physical inventory count at the end of the accounting period. The error caused an:

A. understatement of both net income and assets.

B. overstatement of inventory, purchases, and accounts payable.

C. understatement of inventory, purchases, and accounts payable.

D. overstatement of net income and assets.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 7

67. At the end of 2010, XYZ Company failed to include some goods in its ending inventory and failed to record the purchase of these goods. For 2010, these two errors caused

A. goods available for sale, cost of goods sold, and income to be overstated.

B. ending inventory, cost of goods sold, and retained earnings to be understated.

C. ending inventory, goods available for sale, and retained earnings to be understated.

D. no effect on income, working capital, or retained earnings.

AACSB Tag: Reflective Thinking

Difficulty: Hard

Learning Objective: 7

68. Hollander Company hired some students to help count inventory during their semester break. Unfortunately, the students added incorrectly and ending inventory was overstated by $5,000. What would be the effect of this error in ending inventory?

A. Income would be overstated.

B. Income would be understated.

C. Ending retained earnings would be understated.

D. Cost of goods sold would be overstated.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 7

69. During the audit of Montane Company's 2010 financial statements, the auditors discovered that the 2010 ending inventory had been overstated by $8,000. Before the effect of this error, 2010 pretax income had been computed as $100,000. What should be reported as the correct 2010 pretax income before taxes?

A. $ 92,000.

B. $100,000.

C. None of the other answers is correct.

D. $108,000.

AACSB Tag: Analytic

Difficulty: Hard

Learning Objective: 7

70. Under the periodic method, cost of goods sold is computed by

A. adding the cost of purchases during the period to the cost of the inventory on hand at the beginning of the period and adding this figure to the cost of the inventory on hand at the end of the period.

B. adding the cost of purchases during the period to the cost of the inventory on hand at the end of the period and subtracting the inventory on hand at the beginning of the period.

C. subtracting the cost of the inventory on hand at the ending of the period from the cost of goods available for sale.

D. carefully matching selling and administrative expenses with the sales to which they are related and then reporting these expenses in the same period the associated revenue is reported.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 7

71. Under the perpetual inventory system:

A. one entry is required to record a sales return.

B. cost of goods sold cannot be determined unless a physical inventory is taken.

C. one entry is required to record a sale.

D. a separate account for purchases is not required.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 7

72. Under the periodic inventory system:

A. a transaction by transaction unit inventory record is maintained.

B. the cost of goods sold for each sale is recorded at the time each sale is made.

C. a separate account for purchases is used.

D. a continuous inventory record provides the amount of ending inventory and the cost of goods sold throughout the period.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 7

73. Which of the following may be used to calculate ending inventory (EI) under the periodic inventory system?

A. BI + P + CGS = EI.

B. BI + P - CGS = EI.

C. BI - P + CGS = EI.

D. BI + P + GM = EI.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 7

74. On March 15, 2009, Ryan Company purchased $10,000 of merchandise on credit subject to terms, 2/10, n/30. Ryan Company records its purchases using the gross amount. The periodic inventory system is used. If Ryan Company pays for these goods on March 30, the entry made to record the payment should include

A. $200 credit to Purchase discounts.

B. debit of $9,800 to Accounts payable.

C. debit of $10,000 to Accounts payable.

D. $9,800 credit to cash.

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: 7

75. Two systems are used in accounting for inventory—perpetual and periodic. Which of the following statements is correct?

A. In a perpetual inventory system, the inventory account is not changed for each purchase during the accounting period.

B. In a perpetual inventory system, cost of goods sold is recorded at the time of each sale during the accounting period.

C. In a periodic inventory system, cost of goods sold is developed from a comparison of beginning inventory and ending inventory only.

D. In a periodic inventory system, the inventory account is increased for each purchase during the accounting period.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 7

76. Which one of the following statements concerning the periodic and perpetual inventory systems is true?

A. The periodic system uses a purchases account.

B. Inventory controls are only needed for the periodic inventory systems.

C. None of the accounting entries vary between the two systems.

D. Due to advances in computers, many businesses recently have begun to use the periodic inventory system.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 7

77. When a company uses the periodic inventory system in accounting for its merchandise inventory, which of the following is true?

A. Purchases are recorded in the cost of goods sold account.

B. The inventory account is updated after each sale.

C. Cost of goods sold is computed at the end of the accounting periods rather than at each sale.

D. The inventory account is updated throughout the year as purchases are made.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: 7

78. A LIFO liquidation occurs when a company

A. goes out of business.

B. converts from LIFO to FIFO.

C. converts from the periodic to the perpetual inventory system.

D. sells more units than it purchased during the year.

AACSB Tag: Reflective Thinking

Difficulty: Medium

Learning Objective: Sup A

79. Carrie Company sold merchandise with an invoice price of $1,000 to Underwood, Inc., with terms of 2/10, n/30. Which of the following is the correct entry to record the payment by Underwood Inc., within the 10 days if the company uses the periodic inventory system and the gross method to record purchases?

A.

B.

C. ![]()

D. ![]()

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: Sup B

80. On September 20, 2009, Precision Electric Company purchased $10,000 of stereo equipment for resale on credit, subject to the terms 2/15, n/30. The periodic inventory system is used. If the company paid for these goods on October 18, the entry made to record the payment should include a/an

A. $200 debit to Purchases discounts.

B. $10,000 debit to Accounts payable.

C. $9,800 credit to Cash.

D. $10,000 debit to Purchases.

AACSB Tag: Analytic

Difficulty: Medium

Learning Objective: Sup C

Source: http://www.ateneonline.it/libby/docenti/tb/isbn6609-4_tb_Chap007.doc

Web site to visit: http://www.ateneonline.it

Author of the text: indicated on the source document of the above text

If you are the author of the text above and you not agree to share your knowledge for teaching, research, scholarship (for fair use as indicated in the United States copyrigh low) please send us an e-mail and we will remove your text quickly. Fair use is a limitation and exception to the exclusive right granted by copyright law to the author of a creative work. In United States copyright law, fair use is a doctrine that permits limited use of copyrighted material without acquiring permission from the rights holders. Examples of fair use include commentary, search engines, criticism, news reporting, research, teaching, library archiving and scholarship. It provides for the legal, unlicensed citation or incorporation of copyrighted material in another author's work under a four-factor balancing test. (source: http://en.wikipedia.org/wiki/Fair_use)

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

The texts are the property of their respective authors and we thank them for giving us the opportunity to share for free to students, teachers and users of the Web their texts will used only for illustrative educational and scientific purposes only.

All the information in our site are given for nonprofit educational purposes